The September RETAIL SALES component (RSAFS) of the NBER Recession Model was in today. It surprised to the upside as well as had an upward revision on the prior month.

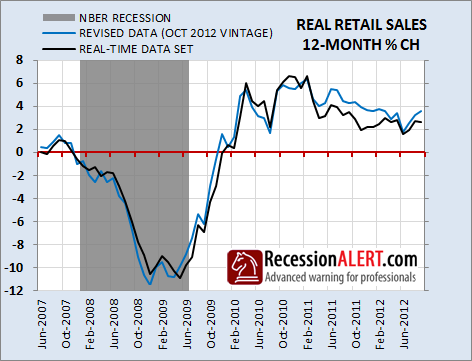

For the most part, this series has been revised downwards over time of late, but this does not necessarily equate to downward revisions to the real-time observed 12-month growth rates. This is shown below where we compare the growth rate of a series that only looks at real-time published data sans revisions (black line) and one that utilises the latest revised data as at today’s date (blue line). We see that since March 2011, the incorporation of revisions into the real-time data set has been resulting in an upward bias to the 12-month % growth rate (i.e. more bullish than originally thought)

This is not always the case though. Our “Effects of revisions on recession forecasting” research note shows that the RSAFS data-set as observed by an outside observer in real-time as the data is published generally provides a more bullish view than the ultimate revised reality around turning points. But not by very much – on average only by an amount that makes 0.5 month difference to a recession dating algorithm using the RSAFS data with 12-month % changes.

In 1970 the real-time data provided a 1 month lead over the revised data and for 1973, 1980 and 1981 the real time data set lagged the revised data by 1 month in flagging a recession. In 1990 and 2008, both the revised data and the real-time data signalled recession in the same month and in 2001 the real time data lagged the revised data in signalling recession by 2 months. Across all 7 recessions, the real-time data averaged a 0.5 months lag on the revised data.

The bottom line is that although real time data observation of RSAFS can be slightly optimistic around turning points, it should not effect a recession dating algorithm using 12month % change very much. The charts above imply that one should only be concerned about possible revisions for RSAFS when 12 month % growth is observed at less than 2% and a short-term downward trend is in place for both real-time and revised data sets. None of these criteria are currently met.

Comments are closed.