NOTE : All images and charts displayed below are regularly updated and available to subscribers from the CHARTS menu.

The SP-500 has enjoyed an incredible 40% rally since the 23 March lows. This was mostly fueled by an unprecedented FED stimulus program, which is now coming to an end within the next few weeks:

Unless more stimulus is unleashed (and a further $1.5-$2 trillion seems likely) the risks of a stock market selloff are high, especially given that the market is some 12.7 to 22% overvalued according to our RAVI US Valuation model (Also see our bear market warning to clients in June 2019):

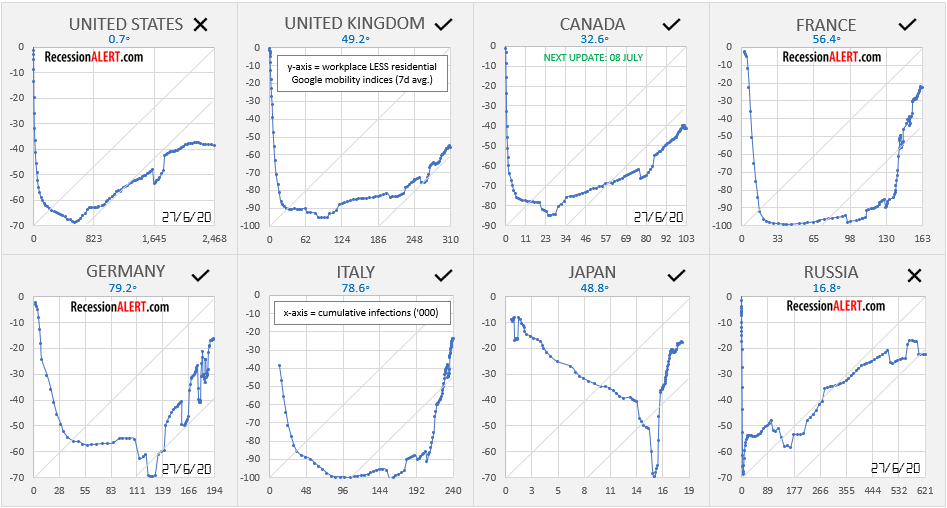

The unlocking of the US economy has now led to a 2nd wave of infections and the US economic mobility index (an excellent high frequency proxy as an economic indicator) is rolling over and falling back to 45% of the pre-recession level:

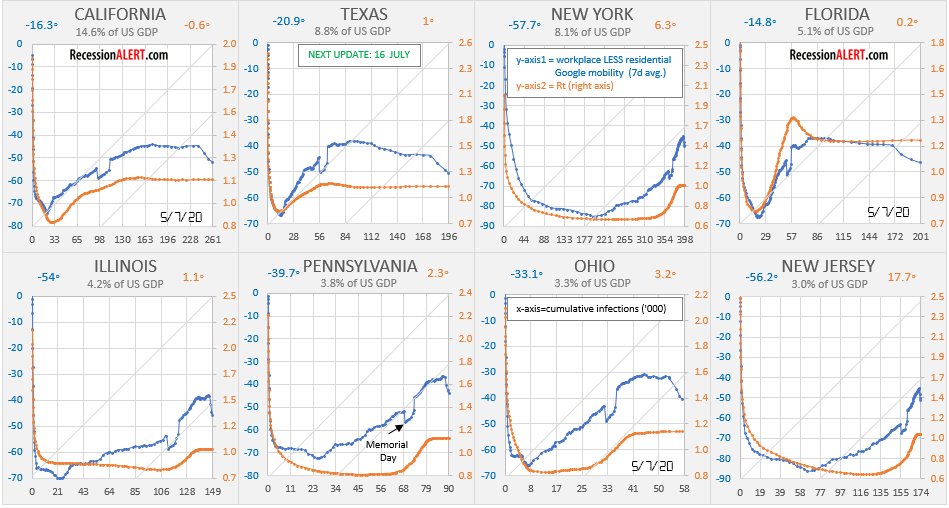

The stock market will not take kindly to this if the rollover persists, and there is every likelihood it will persist, since (1) the economic mobility rollover is broad and covers most US states that matter to the economy (log in to see the next 8 largest economic contributors):

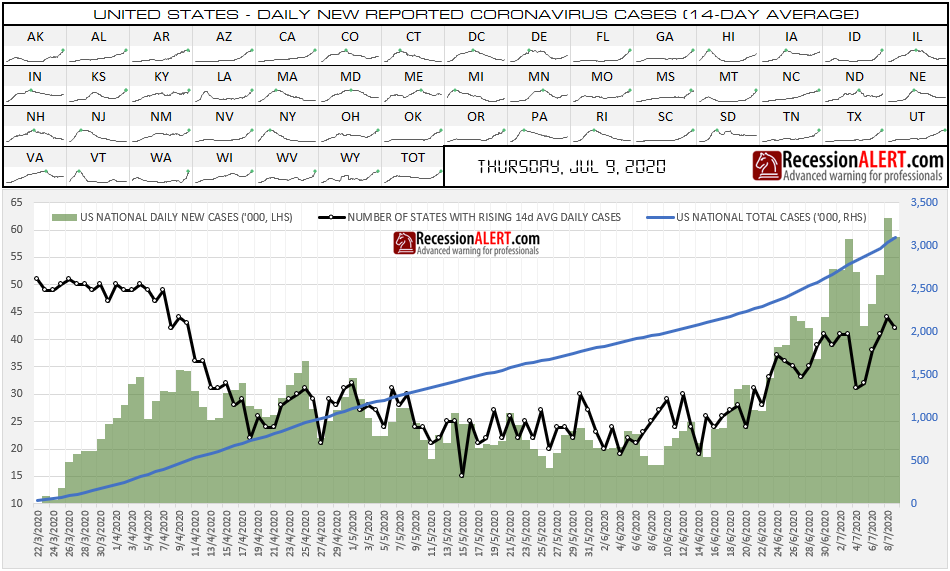

…and (2) the Covid-19 infection spikes are also occurring in most US states, meaning mobility will remain under pressure for a while:

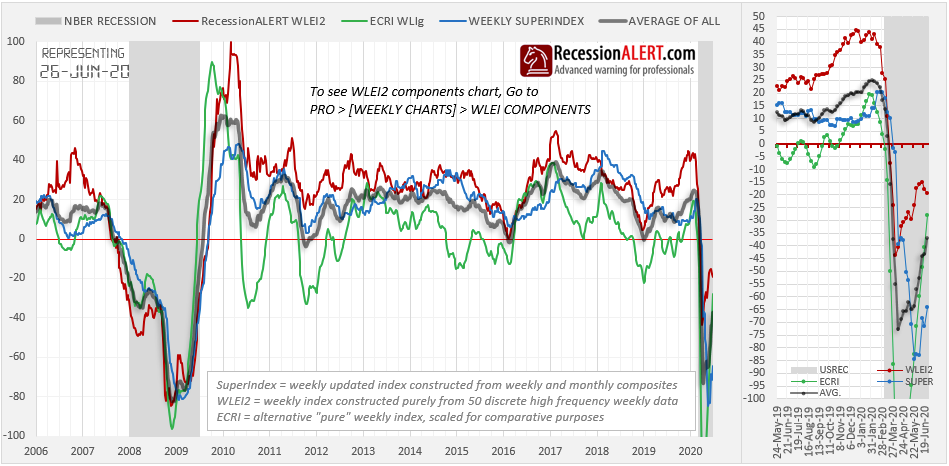

The traditional high-frequency macro-economic data (WLEI2) has been rolling over in the last 2 weeks in sympathy of the economic mobility data:

Interestingly, ECRI’s WLI keeps increasing and is no doubt contaminated with out-sized improvements from weekly claims coming off unprecedented lows which is masking the other components in their series. Since our WLEI2 limits component movement contributions to within 2 historic standard deviations for this exact reason, it does not succumb to this issue.

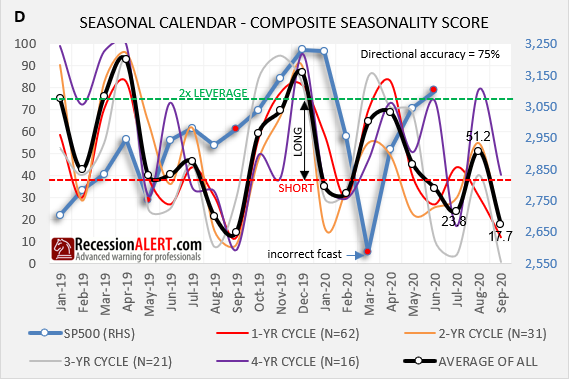

From a seasonality perspective, the month of July is not very bullish with a score of only 23.8 out of 100 according to our Seasonality Model:

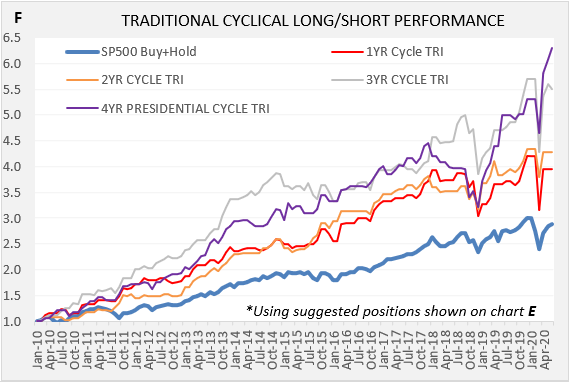

If there is indeed a correction in July, then this will set-up August for a high confidence bullish seasonal month especially for the Presidential (4-year) cycle which suggests a rare 2x leverage month in August. We mention this since the 4-year presidential cycle has outperformed all the other cycles over the last decade:

The risk/rewards are therefore skewed toward the bearish side in the near term and a 5-10% correction is probable unless the conditions we mentioned above change materially. On the positive side we fully expect any dip to be bought hard as undoubtedly the FED will issue another round of stimulus and nobody has ever gone broke by buying the dip on the back of the start of any new stimulus.

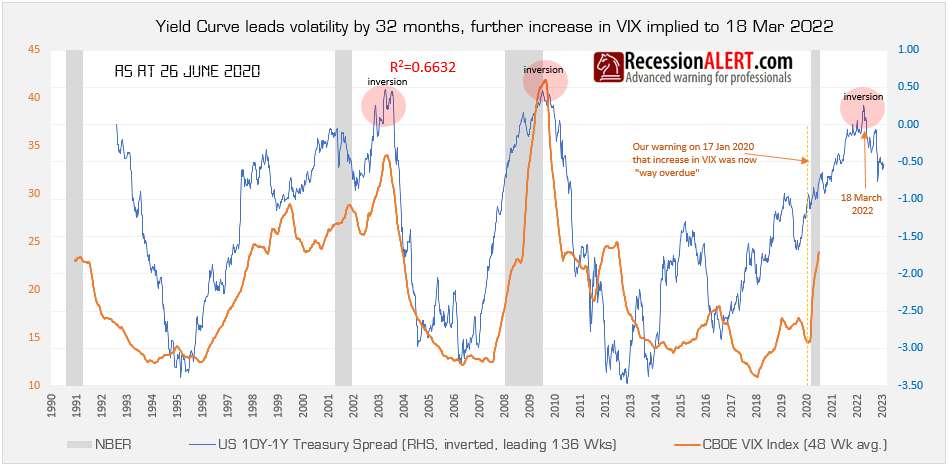

Do not expect any pleasant low volatility long-term rallies though. Literally 3 days after we issued a future increased volatility trend warning on the Long-term Volatility Prediction Model chart update on 17 Jan 2020, the VIX average has been rocketing upwards which is likely to persists to roughly early 2022 (with VIX peaking roughly 12 months earlier around early 2021):

Comments are closed.