The US State and G8 Mobility Charts have just been updated in the Covid menu.

The U.S has seen a whopping increase in infections across a broad swathe of states since emerging from lockdown :

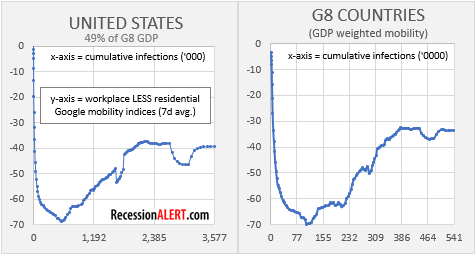

As a result, US and state economic mobility has taken a huge hit. Although the US is only about 49% of the G8 GDP, there are enough G8 members also taking strain to stall the entire G8 group recovery. Since the G8 represent almost 49% of the world GDP we can assume the global V-shaped recovery has been stopped in its tracks:

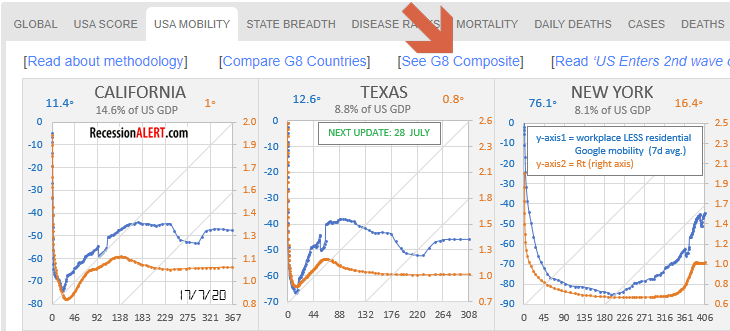

There is a new menu item in the USA MOBILITY tab that allows you to view the G8 GDP-weighted composite as well as mobility of all G8 members together on one comparative chart. Just click on “See G8 Composite” as indicated below:

WHY IS ECONOMIC MOBILITY SO IMPORTANT?

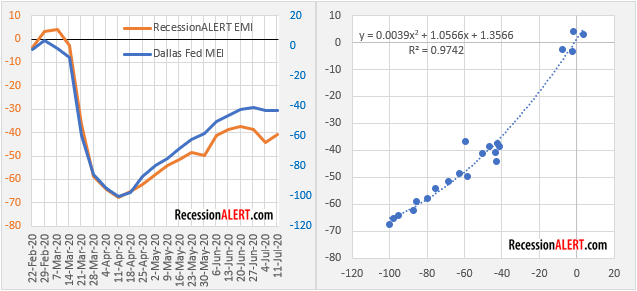

There has been a lot of interesting research into the efficacy of high frequency geolocated mobility indices to represent economic reality. More specifically the new Dallas Fed Mobility and Engagement Index (MEI). Without much doubt, diminished mobility and engagement was a major factor in the slowdown in economic activity and the sharp rise in unemployment. The MEI bears this out with a high correlation to the Dallas Fed Weekly Coincident Economic Index.

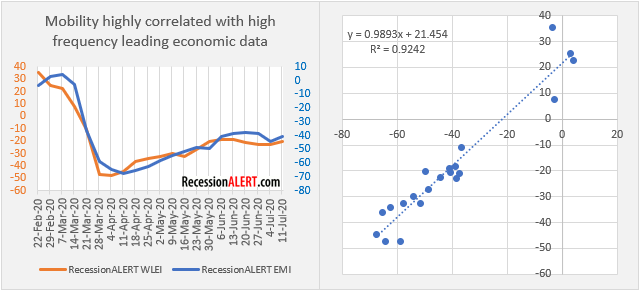

Our Economic Mobility Index (EMI) which is workplace less residential Google mobility indices, and which we use in all our mobility charts, has a 0.924 r-square to our Weekly Leading Economic Index (WLEI):

The RecessionALERT EMI has a remarkable correlation (r-square=0.974) to the Dallas Fed MEI, considering how much simpler and less complex the construction of the EMI is:

We can therefore conclude that high frequency geolocation-derived mobility data is a good proxy for leading weekly economic conditions, given the severity with which mobility has been curtailed during the pandemic. Once we are back to “normal” less pandemic conditions (when mobility is back to pre-lockdown trend), there may not be enough movement in the mobility data to render them as useful anymore however.

This correlation is particularly useful to construct an index of global leading weekly economic conditions (as we have with the G8 composite) to track the global recovery, since there are not many (almost none) high-frequency leading indicators available for representing economic conditions on a global,continent or economic grouping (G8, G20, BRICS etc.) basis.

At this stage we might have to discard the V-shape recovery hypothesis and perhaps look to a Nike swoosh or W-shaped recovery for both the US and the rest of the world.

Comments are closed.