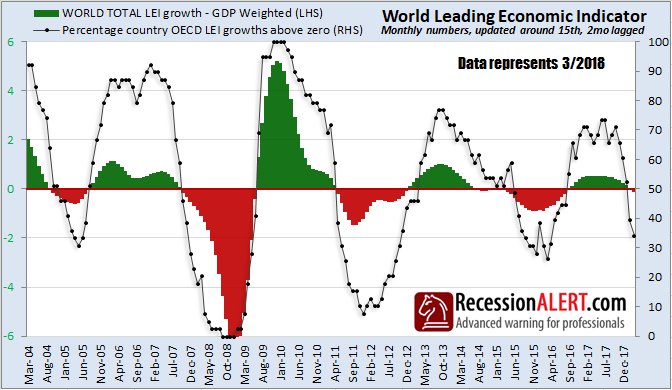

Despite the U.S leading economic indicators appearing healthy, the global economy appears to be headed for a slow down, with only 34% of the 40 countries we track having leading economic indicators (LEI’s) signalling growth ahead, and the actual GDP-weighted Global LEI growth now below zero:

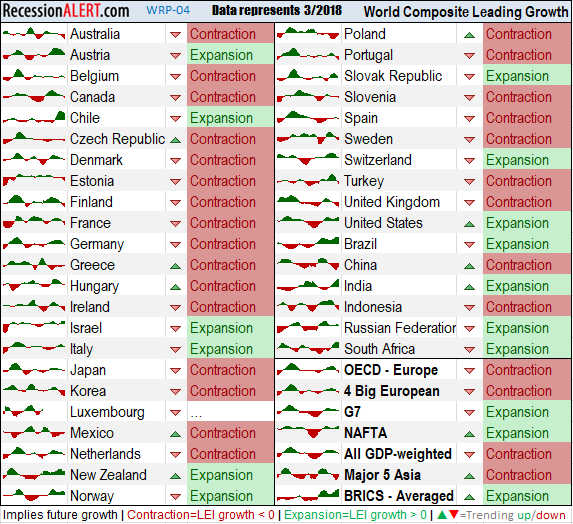

The specific country details are displayed below:

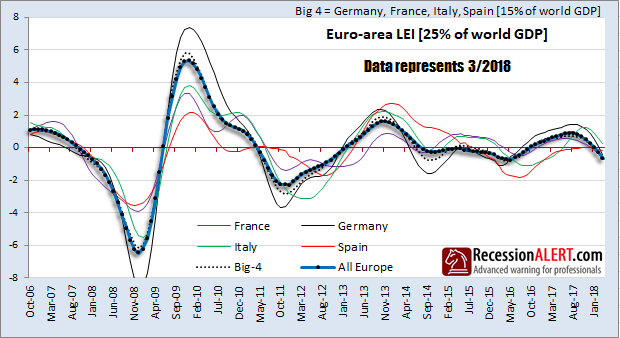

The European countries, representing some 25% of world economic output have taken a decidedly worrisome turn :

Many of these LEI’s include sentiment data, and its probably a fair assumption to assume that the “trade wars” talk doing the rounds of late have a big part to play in these negative future growth projections.

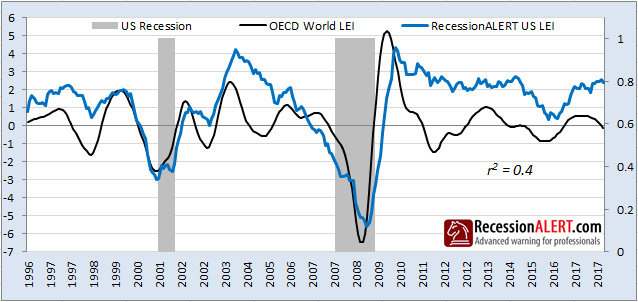

Whilst the RecessionALERT U.S Leading index is currently looking robust, we cannot ignore the fact that there is a not-insignificant 40% correlation between the movements of the U.S LEI and the Global one. In fact a visual inspection shows that downturns in the Global LEI invariably always lead to downturns in the US LEI:

This correlation by no means implies a US recession, but it undoubtedly is likely to put downward pressure on the U.S LEI in the coming months.

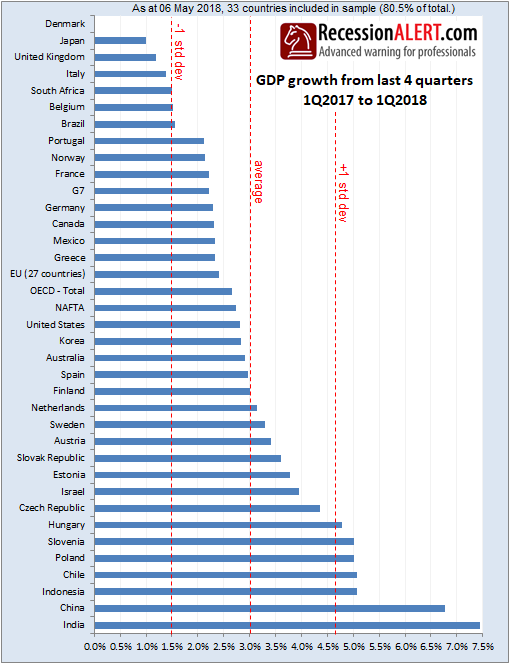

It is early days for the co-incident data and no significant signs of a slowdown can yet be witnessed among them. To this end, here is an interesting chart of country GDP growth from 1Q2017 to 1Q2018:

If you are a RecessionALERT subscriber, you can view the comprehensive global report for May 2018 from the REPORTS menu. You can subscribe to RecessionALERT for a nominal fee over here.

Like this kind of information? We post occasionally to our public Twitter feed here : https://twitter.com/RecessionAlert2

Comments are closed.