Reflections [Expanded version]

MIB: Hormuz Crisis Day 3 — Oil +15%, Stagflation Signal Flashes, Fed Pulls Back on Rate Cuts

US-Iran war enters Day 3 — gold hit $5,417 record Monday, oil +15% this week. S&P 500 -0.94%, trimmed from intraday -2.5% loss after Trump’s Navy escort announcement. Fed’s Williams and Kashkari pull back from 2026 cut forecasts as 10Y yields rise on stagflation fears. UAL -4.09%, DAL -5% on fuel shock. Target (TGT) +7.5% on earnings beat. CrowdStrike beats after the bell.

TABLE OF CONTENTS

A. EXECUTIVE SUMMARY

B. MARKET DATA

C. HIGH-IMPACT STORIES (Minimum 5)

D. MODERATE-IMPACT STORIES (Minimum 5)

E. EARNINGS WATCH

F. ECONOMY WATCH

G. WHAT’S NEXT

A. EXECUTIVE SUMMARY -> TOP

MARKET SNAPSHOT:

US equity markets fell for a second consecutive session as the Iran war entered Day 3, with the S&P 500 losing 0.94% to 6,816.63 — though markets trimmed sharply from intraday losses of 2.5% after President Trump announced US Navy escorts and DFC insurance for Gulf tankers. The defining dynamic of this session was not the headline decline but an unprecedented macro signal: Treasury yields rose alongside falling stocks, with the 10-year yield pushing above 4% while the VIX spiked to 26.43 — a sign that investors are pricing in stagflation, not mere recession risk. The Iran war’s primary market impact is an oil shock ($77.43/bbl WTI, up 15% in three days) that complicates the Fed’s policy path far more than tariffs or technology disruption did. Sector breadth was sharply divided: Energy was the only major sector in green, led by Chevron hitting an all-time high; every other sector declined, making this an oil story playing out across the entire economy rather than a tech or financial dislocation.

TODAY AT A GLANCE:

• S&P 500 -0.94% to 6,816.63 — trimmed from intraday low of -2.5% after Trump’s Gulf tanker announcement; VIX spiked to 26.43 (+18%)

• Stagflation signal flashes: 10Y yield rose to 4.063% even as stocks fell — bonds refuse to rally because oil-driven inflation fears override flight-to-safety demand

• WTI crude +2.9% to $77.43/bbl (cumulative +15% since US-Israel strikes on Iran Feb 28); Strait of Hormuz traffic down 81%; 150+ ships stranded

• Fed rate cut bets collapsed: Fed’s Williams and Kashkari both tempered 2026 cut expectations; market-implied probability of any 2026 cut now near zero

• Earnings bright spot: Target (TGT) +7.5% on Q4 beat and positive 2026 guidance; CrowdStrike (CRWD) beats on all metrics after the bell, shares slightly lower AH on inline guidance

• Gold pulled back from Monday’s record $5,417 ATH to ~$5,185 (-2.4%) as USD strengthened; dollar at 99.07 on safe-haven bid

KEY THEMES:

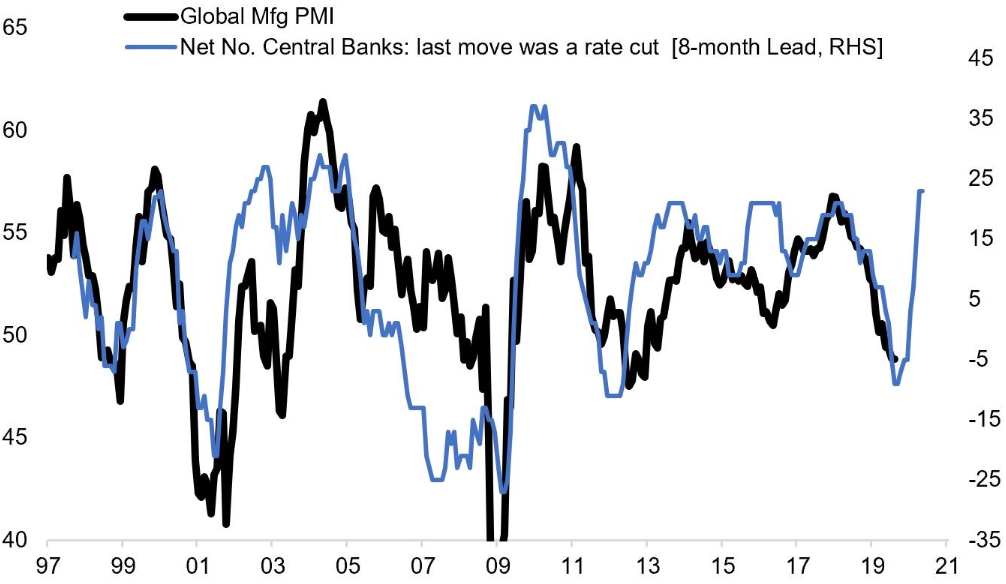

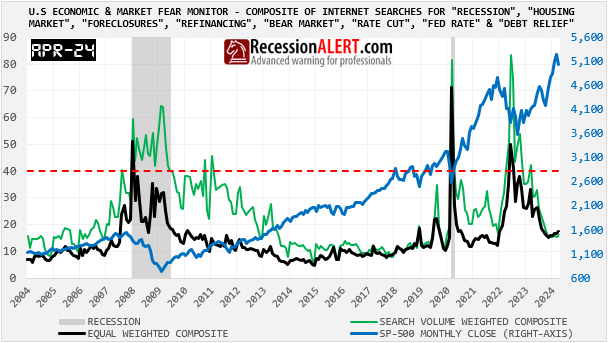

1. The Stagflation Trap Is Now the Base Case — The Iran war has created the Fed’s worst nightmare: rising oil prices that heat inflation just as the economy was already unsteady from tariff uncertainty and slowing hiring. The ISM Manufacturing Prices Index hit 70.5 (a 3.5-year high) the same day oil surged 15%. Rate cuts that were 80% priced in a week ago are now effectively priced out for 2026. The “Great Divergence” — bonds selling off simultaneously with equities — is the clearest signal this is stagflation risk, not a conventional growth shock.

2. The Strait of Hormuz Is Now the Market — With 20% of global oil supply running through a de facto closed waterway, every subsequent session will be priced by one variable: is the Hormuz disruption getting better or worse? Trump’s Navy escort/DFC insurance announcement bought a 1.5% intraday reversal today, but markets will need to see actual tanker traffic resuming — not just policy promises — to sustain any rally. The duration of the closure is the single most important variable in global markets right now.

3. Defense and Energy Are the Only Safe Havens in This Playbook — Traditional safe havens are misfiring: bonds are selling off with stocks, gold hit a record and then retreated, and USD strengthened but didn’t protect equity portfolios. The clear beneficiaries are defense primes (NOC, RTX, LMT) on war spending and energy majors (CVX, XOM) on the oil premium. For portfolio managers, the only effective hedges in this regime are oil exposure and defense sector overweights — not the traditional Treasuries-and-gold playbook.

B. MARKET DATA -> TOP

CLOSING PRICES – Tuesday, March 3, 2026:

MAJOR INDICES

| Index | Close | Change | % Change | Why It Moved |

|---|---|---|---|---|

| S&P 500 | 6,816.63 | -64.74 | -0.94% | Second straight Iran-war session; trimmed intraday -2.5% low after Trump’s Navy escort announcement; energy sole sector in green |

| Dow Jones | 48,501.27 | -403.51 | -0.83% | Energy and defense heavyweights partially offset airline, consumer, and financials drag |

| Nasdaq | 22,516.69 | -231.45 | -1.02% | Growth stocks underperformed as 10Y yields rose; tech had no oil-price hedge |

| Russell 2000 | 2,605.12 | -50.70 | -1.91% | Small-caps most exposed to rate sensitivity and domestic economic slowdown; limited energy offset |

| NYSE Composite | 22,939.86 | -473.45 | -2.02% | Broad-based decline; 10 of 11 sectors finished lower; energy the lone holdout |

VOLATILITY & TREASURIES

| Instrument | Level | Change | Why It Moved |

|---|---|---|---|

| VIX | 26.43 | +4.03 (+18%) | Iran war fear premium; highest close since October 2024; markets pricing prolonged conflict duration |

| 10-Year Treasury Yield | 4.063% | +3 bps | Unusual: yields ROSE as stocks fell — oil-driven inflation fears overwhelmed flight-to-safety demand; 4% floor breached |

| 2-Year Treasury Yield | 3.506% | +2 bps | Rate cut bets collapsed; market now prices near-zero probability of any 2026 Fed cut |

| US Dollar Index (DXY) | 99.07 | +0.70 (+0.71%) | Safe-haven USD bid; dollar strengthened despite broader multi-month “Sell America” trend |

COMMODITIES

| Asset | Price | Change | % Change | Why It Moved |

|---|---|---|---|---|

| Gold | $5,185/oz | -$127 | -2.4% | Pulled back from Monday’s ATH of $5,417; dollar strength capped safe-haven bid; still elevated on Hormuz fears |

| Silver | $82.50/oz | -$6.35 | -7.1% | Sharper decline than gold; industrial metals component hit by global growth slowdown concerns |

| Crude Oil (WTI) | $77.43/bbl | +$2.16 | +2.9% | Third consecutive day of Hormuz-closure premium; Trump announcement trimmed from $83+ intraday high; cumulative +15% since Feb 28 strikes |

| Natural Gas | $3.11/MMBtu | +$0.09 | +3.0% | LNG supply disruption fears; Strait of Hormuz also carries critical LNG volumes for Asian and European markets |

| Bitcoin | $68,997 | +$2,240 | +3.4% | Recovery from Monday’s lows; crypto not a safe haven in geopolitical shocks but bounced as equities trimmed losses |

TOP LARGE-CAP MOVERS:

Selection criteria: US-listed companies with market cap above $25 billion that moved ±1.5% or more during the session. Movers are ranked by percentage change and capped at 5 gainers and 5 decliners. On muted trading days when fewer than 3 names meet the threshold, the largest moves are shown regardless. Moves driven by earnings, M&A, analyst actions, sector rotation, or macro catalysts are prioritized over low-volume or technical moves.

GAINERS

| Company | Ticker | Close | Change | Why It Moved |

|---|---|---|---|---|

| Target | TGT | $107.85 | +7.5% | Q4 2025 earnings beat (EPS $2.44 adj.); FY2026 guidance of ~2% sales growth and $7.50-$8.50 EPS signals return to growth (see Section E) |

| ExxonMobil | XOM | $154.22 | +3.5% | WTI at $77.43/bbl; Hormuz closure drives oil majors higher; Permian Basin production insulated from Middle East disruptions |

| Chevron | CVX | $189.60 | +3.0% | All-time high; domestic Permian Basin output of 1M bbl/day insulated from Hormuz; sole S&P 500 sector winner today |

| RTX Corp | RTX | $216.00 | +2.1% | Second day of Iran war defense premium; Raytheon missile systems and Pratt & Whitney engines central to conflict theater |

DECLINERS

| Company | Ticker | Close | Change | Why It Moved |

|---|---|---|---|---|

| Delta Air Lines | DAL | $59.80 | -5.2% | Jet fuel costs surge with $77 WTI; Tel Aviv route suspended through Mar 9; Middle East airspace closures |

| United Airlines | UAL | $101.91 | -4.09% | Tel Aviv and Dubai route cancellations; fuel cost shock; thinner margin profile than Delta amplifies impact |

| Newmont | NEM | $119.40 | -8.0% | Gold retreated -2.4% from Monday’s $5,417 ATH; miners amplify metal price moves; profit-taking after Monday surge |

| Northrop Grumman | NOC | $723.56 | -1.81% | Day 2 profit-taking after Monday’s +6% Iran war surge; defense sector broadly gave back a portion of initial gains |

C. HIGH-IMPACT STORIES -> TOP

BEARISH

1. Strait of Hormuz Effectively Closed — Iran War Cuts Off 20% of World Oil Supply for Third Day

The core facts:US-Israel Operation Epic Fury strikes on Iran (launched Feb 28) killed Supreme Leader Khamenei and triggered Iran to declare the Strait of Hormuz closed. As of Tuesday, at least five oil tankers have been damaged, two crewmen killed, and approximately 150 ships are stranded in and around the strait. Traffic through the waterway is down 81% from the prior week. Major shippers — Maersk, MSC, Hapag-Lloyd, COSCO, and CMA CGM — have suspended all Gulf bookings. Tanker insurance was withdrawn by underwriters, forcing the US to step in with DFC political risk coverage. The VLCC freight rate (Middle East to China) hit a record $423,736/day — a 94% surge in a single session.

Why it matters:The Strait of Hormuz carries approximately 20 million barrels of oil per day — one-fifth of global supply — plus LNG critical to Asian and European energy markets. At $77.43/bbl WTI (up 15% from pre-conflict levels), every $10 further increase adds an estimated 0.2 percentage points to CPI. Gas prices jumped 11 cents overnight to $3.11/gallon. If Brent pushes past $90 — a credible scenario if the closure extends beyond two weeks — it would represent the most severe energy shock since the 2022 Russian invasion of Ukraine, and would force the Fed to choose between cutting rates to cushion growth or holding rates to fight oil-driven inflation.

What to watch:Monitor daily tanker traffic data through the strait (Kpler and Vortexa provide near-real-time AIS tracking); watch whether Iran signals willingness to negotiate with the US before the conflict becomes a multi-week stalemate; watch Brent crude for a break above $85 — that would accelerate the policy dilemma for the Fed.

UNCERTAIN

2. Trump Orders Navy Escorts and DFC Insurance for Gulf Shipping — Market Gets a 1.5% Intraday Reversal

The core facts:President Trump announced Tuesday that the US Development Finance Corporation (DFC) would immediately provide political risk insurance and guarantees for “ALL Maritime Trade, especially Energy, traveling through the Gulf.” He added that the US Navy would begin escorting tankers through the Strait of Hormuz “if necessary, as soon as possible.” Markets responded sharply: the S&P 500 reversed from an intraday low of -2.5% to close -0.94%, and Brent crude pulled back from its intraday high above $83/bbl to close around $79/bbl (+2% on the day after a +6% surge Monday). Oil tanker stocks surged, with Maersk +7.8% and Hapag-Lloyd +6.7%.

Why it matters:The announcement reduces the tail risk of a permanent or prolonged Hormuz closure by promising US state-backed insurance and military protection — the two barriers that shut down commercial shipping (no insurance coverage, no naval protection). However, the DFC has never provided this type of war-risk coverage at scale, and Navy escorts require significant logistical preparation. Markets effectively gave Trump a “benefit of the doubt” rally today, but the test is execution: if tanker traffic through the strait doesn’t resume within days, the rally will reverse. The uncertain sentiment reflects genuine binary risk — diplomatic resolution is possible, but so is Iranian escalation against US Navy assets.

What to watch:Monitor whether the first Navy-escorted convoy departs and whether commercial insurers re-engage on tanker war-risk policies; watch for Iranian responses to the escort announcement — any attack on US Navy vessels would represent a significant escalation.

BEARISH

3. Fed Rate Cut Bets Collapse to Near Zero — Williams and Kashkari Pull Back From 2026 Easing Forecasts

The core facts:Two Federal Reserve officials spoke Tuesday in unusually cautious terms about the Iran war’s policy implications. New York Fed President John Williams said the economic fallout “hinges on how long they affect asset prices, especially the price of oil,” adding “We’ll have to see how persistent this is.” Minneapolis Fed President Neel Kashkari, who had previously supported at least one 2026 rate cut, said “With the geopolitical events we talked about, I just need to see” — effectively pulling his rate cut support. Market-implied probability of any 2026 Fed rate cut plummeted to near zero Tuesday, compared to an 80% probability of a March cut just one week ago. The 10-year Treasury yield rose to 4.063%, confirming the market is pricing out rate relief.

Why it matters:Every $10 oil price increase adds an estimated 0.2 percentage points to CPI — a meaningful inflation headwind if oil stays elevated. With WTI already $12+ above pre-conflict levels, the oil shock alone could add 0.2-0.3% to CPI in March and April. The Fed has spent two years fighting inflation and cannot credibly restart rate cuts while energy prices surge. Rate-sensitive sectors — small-caps, REITs, homebuilders, financials dependent on NIM spreads — face an extended higher-rate environment just as the economy was already showing cracks. The March 19 FOMC meeting, just two weeks away, will be the first real test of the Fed’s updated stance.

What to watch:Watch for February CPI (expected around March 12) — the last inflation print before the March 19 FOMC meeting; watch March CME FedWatch tool for any recovery in cut expectations; monitor any emergency Fed communications if oil pushes past $90.

BEARISH

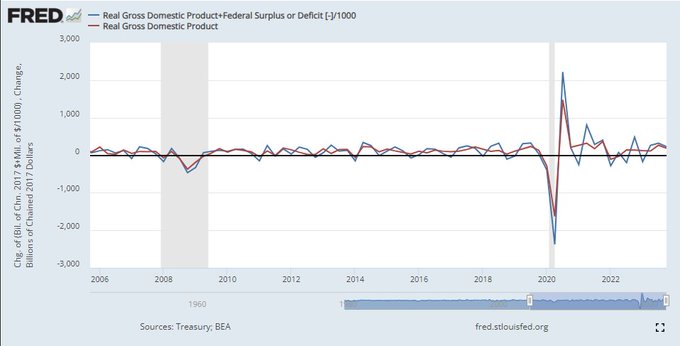

4. Bonds Sell Off Alongside Stocks — Treasury Market Flashes the Stagflation Signal

The core facts:In a textbook stagflation market signal, the 10-year Treasury yield rose to 4.063% (+3 bps) even as the S&P 500 fell 0.94% and the VIX spiked to 26.43 (+18%). The 2-year yield rose to 3.506% (+2 bps). The 10Y hit an intraday high of 4.117% before pulling back. This “Great Divergence” dynamic — where both bonds and stocks sell off simultaneously — signals that investors are pricing in higher inflation (from oil), not just slower growth. The US Dollar Index rose 0.71% to 99.07 as the dollar became the default safe haven, while gold pulled back 2.4% from its Monday all-time high of $5,417.

Why it matters:In a conventional geopolitical shock, investors flee to Treasuries, yields fall, and bonds buffer equity losses. The Iran war has broken this playbook: oil inflation fears are large enough to overwhelm the flight-to-safety demand for Treasuries. This is the defining characteristic of a stagflationary environment — not available in the standard 60/40 portfolio toolkit. The dollar, which was weakening on “Sell America” narratives as recently as last week, has received a temporary safe-haven bid, adding a new complication for multinational US companies with foreign revenue. Historically, stagflationary regimes (1973-74, 1979-80) produced the worst equity outcomes of the 20th century.

What to watch:Watch whether the 10Y yield breaks above 4.5% — that would signal a new rate regime and force more portfolio de-risking; monitor 5-year breakeven inflation rates (market-implied inflation expectations) for how much of the oil shock is being priced as temporary vs. structural.

UNCERTAIN

5. Gold Hits Record $5,417 Monday Before Retreating — The Dollar Vs. Inflation Hedge Tug-of-War Begins

The core facts:Gold surged to an intraday all-time high of $5,417/oz Monday as investors initially treated it as the primary safe-haven instrument in the Iran war. On Tuesday, gold retreated to approximately $5,185/oz (-2.4%) as the strengthening dollar (DXY +0.71% to 99.07) created competing safe-haven demand. Silver fell more sharply (-7.1% to $82.50/oz), reflecting greater industrial-metals sensitivity. Gold miners amplified the pullback: Newmont (NEM) fell ~8%. The “Great Divergence” of rising yields and rising gold simultaneously — which defined Monday’s session — was partially unwound Tuesday as the dollar asserted itself.

Why it matters:Gold’s behavior in this conflict exposes a genuinely new market dynamic: with Treasuries no longer functioning as the safe haven (yields rising), investors initially piled into gold, but the dollar has emerged as the competing safe haven. The question for portfolio managers is which safe haven wins — gold (if the conflict is prolonged and stagflationary) or the dollar (if investors prioritize liquidity). Historically, in extended oil shock regimes, gold eventually outperforms the dollar because inflation erodes purchasing power faster than currency strength gains. The Monday record at $5,417 may prove a near-term ceiling if the dollar continues strengthening, but a floor for the medium term if Hormuz remains disrupted.

What to watch:Watch gold for a hold above $5,000 — if that level breaks, it signals the dollar winning the safe-haven battle; watch GLD ETF flows for institutional vs. retail positioning shifts; monitor Newmont and Barrick earnings as a real-time read on miner profitability at $5,000+ gold.

D. MODERATE-IMPACT STORIES -> TOP

BULLISH

6. Energy Sector Surges as Only S&P Green Zone — Chevron Hits All-Time High of $189.60

The core facts:With 10 of 11 S&P 500 sectors closing in the red, Energy was the dramatic exception. Chevron (CVX) hit an all-time high of $189.60, gaining approximately 3.0% as WTI crude surged to $77.43/bbl. ExxonMobil (XOM) closed at $154.22 (+3.5%) as Permian Basin domestic production insulates both majors from Hormuz supply disruptions while they benefit from the $77+ oil price environment. The energy sector broadly gained 3-5%, its strongest two-day performance in over a year. Halliburton and other oil-field services names posted even larger gains on the expectation that higher oil prices will accelerate non-Hormuz drilling globally.

Why it matters:The bifurcation of the energy sector from the rest of the market illustrates the precise investment thesis of this conflict: domestic oil producers are dual beneficiaries — they earn more per barrel while being geographically insulated from the Middle East disruption. Chevron’s Permian Basin production of 1 million barrels/day generates exceptional free cash flow at $77 oil vs. the $65 pre-crisis price. For portfolio managers, this confirms the energy sector overweight as the most direct Iran-war hedge available in large-cap US equities.

What to watch:Watch the XLE energy ETF for sustained sector momentum; monitor whether energy’s outperformance extends to week 2 of the conflict — historically, energy stocks peak 5-10 days after a geopolitical oil shock and then consolidate.

BEARISH

7. Airlines Collapse for Second Day — United, Delta, American Hit by Dual Shock of Fuel Costs and Route Cancellations

The core facts:US airline stocks extended Monday’s losses on Tuesday as jet fuel costs and Middle East airspace closures combined in a brutal double hit. Delta Air Lines (DAL) fell 5.2% to $59.80 as it suspended Tel Aviv service through March 9. United Airlines (UAL) declined 4.09% to $101.91 after halting Tel Aviv service through March 6 and canceling Dubai flights through March 4. American Airlines (AAL) fell 4.82% to $12.44 after canceling its Philadelphia-to-Doha route. Fuel costs represent up to 30% of airline operating expenses, making a $12/bbl oil spike an immediate and material margin threat.

Why it matters:Airline stocks function as a leveraged short on oil prices — each sustained $10/bbl oil increase typically reduces annual EPS by 10-15% for a major carrier. With WTI up $12+ since the conflict began, 2026 earnings guidance for the airlines is immediately at risk. Revenue disruption from cancelled routes compounds the fuel cost impact: high-margin business travelers to Dubai, Tel Aviv, and Doha represent disproportionate fare revenue. If the conflict extends for more than 2-3 weeks, airlines will face both fuel hedging gaps (most carriers hedge only 30-50% of fuel) and demand destruction from Middle East travel avoidance.

What to watch:Watch airline management guidance updates for 2026 EPS revisions; monitor jet fuel (jet kerosene) spot prices separately from WTI; watch whether route cancellations extend to broader Gulf region beyond the current Tel Aviv/Dubai/Doha suspensions.

BULLISH

8. Defense Sector Extends Iran War Rally — Northrop, RTX, Lockheed Martin Sustain Premium Into Day 2

The core facts:Defense primes continued to command a war premium on Tuesday, though with some intraday profit-taking from Monday’s outsized gains. RTX Corporation added 2.1% to approximately $216.00, extending Monday’s 4.5-4.7% surge. Northrop Grumman (NOC) gave back 1.81% after Monday’s explosive 6% gain, settling at $723.56. Lockheed Martin (LMT) held near $681, near multi-month highs. The sector had already been pricing in a global rearmament cycle: Lockheed’s stock is up approximately 40% year-to-date entering the conflict, as US-Iran tensions had been escalating since late 2025. The Iran conflict — which involves active use of precision munitions, missile defense systems, and stealth aircraft — directly showcases the capabilities of US defense primes’ product lines.

Why it matters:Geopolitical conflicts historically generate sustained defense stock outperformance for 3-6 months, not just the initial 1-2 day spike. Active combat operations accelerate munitions consumption and create immediate replenishment orders. Congressional supplemental defense spending is likely if the conflict extends, further supporting multi-year backlog growth. For portfolio managers, the question is whether Monday’s gains are fully priced (given the 40% YTD run-up in LMT) or whether defense primes have further room to run as the conflict drags on.

What to watch:Watch for Congressional supplemental defense spending authorization proposals; monitor Pentagon contract announcements for precision munitions replenishment (JASSM, PAC-3, SM-6 — RTX and LMT products central to the theater).

BEARISH

9. ISM Manufacturing Prices Index Hits 3.5-Year High at 70.5 — Pre-Existing Inflation Pressure Meets the Oil Shock

The core facts:The February ISM Manufacturing PMI, released Monday March 2, showed headline activity at 52.4 (above estimates of 51.8, second consecutive month of expansion), but buried in the report is the alarming data: the Prices Paid subindex surged to 70.5 from 59.0 in January — the highest reading since June 2022 and a 19.5-point one-month leap. The jump was driven by steel, aluminum tariff impacts, and broad-based imported goods cost increases. New orders slowed to 55.8 from 57.1, and employment remained in contraction at 48.8, signaling that factories are paying more for inputs even as hiring stays weak.

Why it matters:The 70.5 Prices Paid reading means that even before the Iran war oil shock, US manufacturers were experiencing the fastest input cost inflation in 3.5 years — already a stagflation warning. The oil shock now adds an energy cost layer on top of the tariff-driven materials cost surge. March and April ISM Prices data — which will incorporate the oil shock — could approach or exceed the 2022 peak of 87.1. This is the clearest empirical evidence that the “transitory inflation” narrative the Fed had been counting on is now in reverse.

What to watch:ISM Services PMI releases Wednesday March 4 — watch whether the services sector prices paid index also accelerated in February; watch the March ISM Manufacturing report (release April 1) for evidence of the oil shock compounding the already-elevated prices.

UNCERTAIN

10. Oil Tanker Freight Rates Hit Record $423,736/Day — Shippers Halt; Tanker Owners Profit

The core facts:The benchmark freight rate for Very Large Crude Carriers (VLCCs) — the supertankers carrying 2 million barrels from the Middle East to China — hit a single-session record of $423,736/day on Monday, representing a 94% surge from the previous session. Maersk climbed 7.8% and Hapag-Lloyd rose 6.7% as diversion routes around the Cape of Good Hope create higher utilization for the global fleet. Nordic American Tankers, International Seaways, and Teekay Tankers also advanced. Simultaneously, major container shippers suspended Gulf bookings: Maersk, MSC, CMA CGM, Hapag-Lloyd, COSCO, and Emirates SkyCargo all halted UAE, Oman, Iraq, Kuwait, Qatar, and Saudi Arabia bookings until further notice.

Why it matters:Record freight rates are a supply chain inflation tax. Every tanker or container redirected around the Cape of Good Hope adds 10-14 days of transit time and $500K-$2M in additional fuel costs — costs that are passed on to end consumers globally. For US importers of goods that transit through the Gulf, this represents a fresh inflationary shock on top of existing tariff cost increases. The situation is a mirror of the 2023-24 Red Sea crisis, but with direct US military involvement making diplomatic resolution more complex. The bifurcated impact — windfall for tanker owners, pain for shippers and consumers — is the definition of uncertain market sentiment.

E. EARNINGS WATCH -> TOP

Selection criteria: This section covers only market-moving earnings from large-cap companies (>$25B market cap) with sector significance or systemic implications. The S&P 500 scorecard above tracks all 500 index components, but individual stories below focus on names large enough to move markets and provide economic signals relevant to US large-cap portfolio managers. On any given day, 30-80+ companies may report earnings, but MIB filters for the 2-5 names most relevant to institutional investors.

YESTERDAY AFTER THE BELL (Markets Reacted Today)

BEARISH

11. MongoDB (MDB): -21.8% | Beat on Revenue and EPS, But Guidance Missed and Two Senior Executives Are Out

The Numbers:Q4 FY2026 revenue: $695.1M (+27% YoY), beat estimates of $669-$674M. Adjusted EPS: $1.65, beat estimates of $1.47 by $0.18. Atlas revenue +29% YoY. RPO doubled to $1.47B (+97% YoY). Full-year revenue: $2.46B (+23%), with $2.4B cash. Q1 FY2027 guidance: Revenue $659-$664M (vs. est. $662M — barely in-line); Adjusted EPS $1.15-$1.19 (vs. est. $1.21 — MISS). FY2027 revenue guidance: $2.86-$2.90B. Released: AMC, March 2, 2026.

The Problem/Win:Despite a clean beat on Q4 fundamentals, three problems combined to collapse the stock. First, Q1 EPS guidance of $1.15-$1.19 missed the $1.21 analyst consensus — not by much, but enough to signal deceleration. Second, two key commercial leaders departed simultaneously: Cedric Pech (President of Field Operations) and Paul Capombassis (Chief Revenue Officer). Dual revenue leadership departures ahead of a new fiscal year is a red flag that raises questions about sales execution and pipeline conversion. Third, the Iran war macro environment — with risk appetite suppressed and the Nasdaq already under pressure — amplified the sell-off to a peak intraday decline of 29.8%.

The Ripple:MongoDB’s decline contributed meaningfully to the Nasdaq’s -1.02% session as a $60B+ market cap component. Peer database and cloud software names (Snowflake, Oracle, Databricks proxies) came under sympathy pressure. UBS lowered its price target on MDB following the report, and multiple analysts slashed forecasts on the guidance miss and leadership concerns.

What It Means:MongoDB’s drop is a reminder that even strong fundamental beats can be punished when guidance disappoints and management stability is questioned. In a market already pricing in macro risk from the Iran war, a software company losing its CRO and sales president in the same quarter signals potential commercial disruption that the next 1-2 quarters will need to disprove. The RPO doubling to $1.47B is a genuine positive — suggesting contract demand remains strong — but the market will need to see that translate into revenue before re-rating the stock.

What to watch:Monitor Q1 FY2027 results (due ~June 2026) for evidence that the RPO backlog converts cleanly despite the CRO transition; watch whether MDB finds named replacements for the CRO and President of Field Operations within 60 days — prolonged vacancies would confirm the bear thesis.

TODAY BEFORE THE BELL (Markets Already Reacted)

UNCERTAIN

12. Target (TGT): +7.5% | Q4 2025 EPS Beat Masks Weak Comps; 2026 Guidance Seen as Recovery Signal

The Numbers:Q4 2025 net sales: $30.5B (-1.5% YoY). Adjusted EPS: $2.44 vs. $2.41 in Q4 2024 (beat analyst estimates). Comparable store sales: -2.5% (comparable stores -3.9%, digital +1.9%). FY2026 guidance: ~2% net sales growth; EPS $7.50-$8.50 (midpoint $8.00 vs. FY2025’s $7.57 adjusted). Q1 FY2026 EPS: flat to slightly up vs. $1.30 a year ago. Released: BMO, March 3, 2026.

The Problem/Win:Target’s Q4 was technically a beat but fundamentals remain soft — comparable sales have been negative for multiple consecutive quarters and revenue actually declined 1.5%. The stock’s 7.5% surge was driven entirely by the FY2026 outlook of $8.00 EPS at midpoint and modest sales growth, which the market interpreted as a genuine inflection after an extended period of underperformance. The forward-looking guidance reset expectations from “turnaround in question” to “recovery underway.”

The Ripple:Other consumer discretionary retailers saw mixed moves; Walmart held broadly flat. Barclays noted skepticism about the CEO’s optimism, suggesting not all analysts are buying the recovery narrative. The Iran war context created an unusual backdrop — a consumer staples-adjacent retailer rallying 7.5% on a day when the broader market was down nearly 1% from geopolitical shock.

What It Means:Target’s guidance is rated UNCERTAIN because the 2026 recovery thesis depends on consumer spending holding up at a time when gas prices just jumped 11 cents/gallon and inflation may be re-accelerating from oil costs. An Iran-driven energy shock directly hits Target’s customer base (value-oriented consumers highly sensitive to fuel prices), adding risk that the FY2026 guidance will need to be revised downward.

What to watch:Monitor Q1 FY2026 comps (expected flat to slightly up per guidance) as the first test of the recovery; watch gas price trajectory — if WTI stays above $75, Target’s core consumer will face real budget pressure that undermines the 2026 guidance story.

TODAY AFTER THE BELL (Markets React Tomorrow)

BULLISH

13. CrowdStrike (CRWD): AH ~-1.5% | Record ARR Surpasses $5B, Revenue +23% — Muted Reaction Blamed on Iran War Macro Fog

The Numbers:Q4 FY2026 revenue: $1.31B (+23% YoY vs. $1.06B in Q4 FY2025). Adjusted EPS: $1.12 (beat estimates of $1.10 by $0.02). Annual Recurring Revenue (ARR): $5.25B — first cybersecurity pure-play to cross $5B ARR. Net New ARR (Q4): $331M (+47% YoY). Free cash flow: $376.4M (beat estimates of $339.4M). FY2027 guidance: Revenue $5.868-$5.928B; Adjusted EPS $4.78-$4.90. Released: AMC, March 3, 2026. AH move: approximately -1.5% to $372.80.

The Problem/Win:This is a clear operational win for CrowdStrike: record ARR, first $5B ARR milestone in pure-play cybersecurity history, 47% net new ARR growth, and free cash flow beating by $37M. The modest after-hours decline (-1.5%) reflects two dynamics: (1) the Iran war macro environment damping risk appetite for high-multiple growth names, and (2) FY2027 guidance implies revenue growth decelerating from ~23% to approximately 12-13%, which disappointed the most aggressive growth bulls. However, guidance described as “slightly above expectations” suggests the deceleration narrative may be market over-reaction.

The Ripple:Cybersecurity sector peers — Palo Alto Networks, Zscaler, SentinelOne — will be watched carefully Wednesday. A strong CrowdStrike report typically lifts sector sentiment. The Iran war itself may be creating new demand signals for cybersecurity: state-sponsored Iranian cyberattacks historically accompany kinetic conflicts, potentially accelerating enterprise security spending.

What It Means:CrowdStrike’s core business is strong — the $5B ARR milestone and 47% net new ARR growth suggest the 2024 CrowdStrike IT outage incident is fully behind them in terms of customer trust. The after-hours dip is attributed to macro fog rather than fundamental weakness. Rated BULLISH on operational results; the AH reaction likely underestimates medium-term strength.

What to watch:Watch CRWD’s Wednesday regular session open for a clearer read on market sentiment; monitor Q1 FY2027 ARR guidance updates on the earnings call; watch for cybersecurity sector re-rating if Iranian cyber operations escalate alongside the kinetic conflict.

WEEK AHEAD PREVIEW:

Q4 2025 earnings season is approximately 96% complete. Notable reporters in the coming week include several retailers and mid-cap tech names. The earnings calendar is lighter than recent weeks, with the macroeconomic focus (Iran war, Friday NFP) dominating. Key upcoming earnings: Dick’s Sporting Goods (DKS) and Dollar General (DG) are expected to report this week, providing additional consumer health signals. The Q1 2026 earnings season kicks off in mid-April — with oil-exposed sectors facing material estimate revision risk if Hormuz remains disrupted.

F. ECONOMY WATCH -> TOP

Tracking U.S. economic indicators and commentary from the past 3 days.

Iran War Stagflation Threat: Economists Warn of $100 Oil and Fed Policy Trap (Multiple Sources, March 3, 2026)

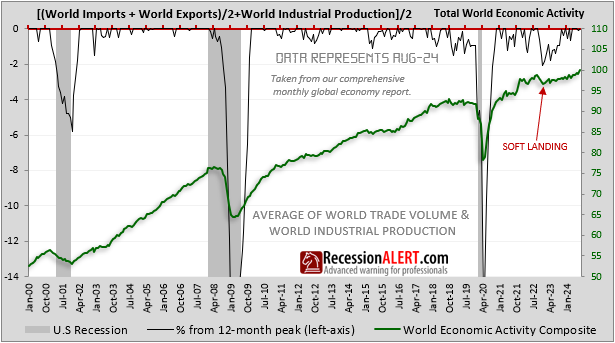

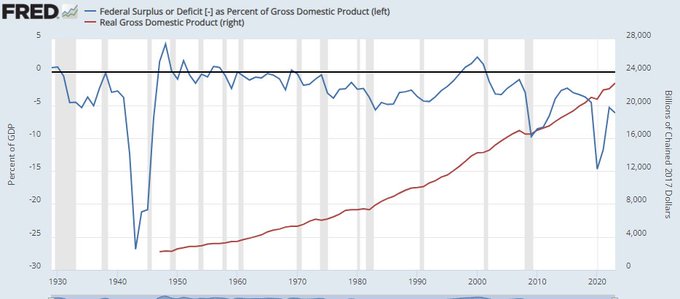

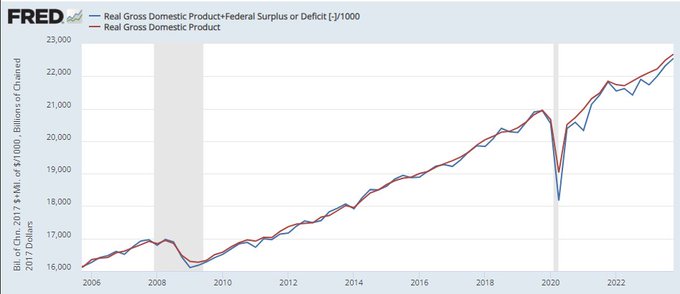

What they’re saying:Multiple leading economists and banks issued stagflation warnings Tuesday. Maybank warned a prolonged oil crisis from the Iran war “could lead to stagflation.” Barclays’ Emmanuel Cau noted that “while this conflict heightens stagflationary risks for the global economy, it is unfolding against a backdrop of favorable growth-policy mix and resilient earnings” — a cautiously optimistic qualification. JPMorgan placed 35% probability on a US and global recession in 2026, while Goldman Sachs revised its 12-month recession forecast to 20% (from 15%). By one estimate, the current $12+ oil shock adds approximately 0.25% to CPI — a meaningful headwind when the Fed’s 2% target is already fragile.

The context:The US economy was already “unsteady” entering the conflict — hiring in 2025 was the weakest outside of a recession since 2002, tariff uncertainty had been weighing on business confidence, and ISM Manufacturing prices were already at a 3.5-year high before the oil shock. A prolonged conflict that pushes WTI past $90/bbl would compound all three existing headwinds simultaneously: higher inflation, slower growth, and tighter financial conditions. The Fed has no good options: rate cuts risk embedding oil-driven inflation, while holding rates risks tipping a slowing economy into recession.

What to watch:Friday March 6 February jobs report — if payrolls disappoint while oil is surging, that is the clearest stagflation confirmation; watch oil at $90 WTI as the threshold that changes the Fed’s calculus from “wait and see” to emergency posture.

ISM Manufacturing Prices Paid Surges to 70.5 — Highest Since June 2022 (ISM, March 2, 2026)

What they’re saying:The February ISM Manufacturing PMI headline of 52.4 (above estimates of 51.8) masked a deeply concerning Prices Paid subindex of 70.5 — a 19.5-point surge from January’s 59.0 and the highest reading since June 2022. New orders slowed to 55.8 from 57.1. Employment remained in contraction territory at 48.8. Respondents cited steel, aluminum, and imported goods costs as primary price drivers, with tariffs explicitly mentioned. Overall manufacturing is expanding, but factories are paying the most for inputs in 3.5 years while employment shrinks.

The context:A Prices Paid reading above 70 historically correlates strongly with broad CPI acceleration 4-6 weeks later, as input costs work through supply chains to finished goods prices. The last time this index was at 70+ (June 2022), CPI reached 9.1% shortly thereafter. The current context is far less extreme — underlying inflation is much lower — but the ISM prices signal reinforces that the Fed’s “last mile” to 2% inflation was already getting harder before the Iran oil shock layered on additional cost pressure.

What to watch:ISM Services PMI releases Wednesday March 4 — watch services prices for confirmation of a broad-based inflation re-acceleration; next ISM Manufacturing report releases April 1, expected to show further price acceleration from oil shock.

GDPNow Holds at 3.0% for Q1 2026 — Growth Was Resilient Before the Oil Shock (Atlanta Fed, March 2, 2026)

What they’re saying:The Atlanta Fed’s GDPNow model estimate for Q1 2026 real GDP growth held steady at approximately 3.0% as of the March 2 update, having edged down slightly from 3.1% at the February 24 update. The model incorporates available hard data through early March and does not yet fully reflect the Iran war oil shock impact on consumer spending, trade flows, or business investment. The Q1 reading of 3.0% would represent solid growth — consistent with full-employment expansion — if realized.

The context:The 3.0% GDPNow reading is the last clean pre-conflict baseline before the Iran shock. It tells us the economy was on firm footing going into the conflict — not already teetering on a cliff edge. This matters for the stagflation debate: a growth shock from oil prices hitting an already-contracting economy is far more dangerous than one hitting a 3%-growth economy. Goldman Sachs economists estimate that a $10/bbl sustained oil increase shaves 0.1 percentage points from GDP growth — manageable if oil stays near current levels, but more material if Brent breaches $100.

What to watch:Watch GDPNow updates as March data (retail sales, consumer confidence, trade balance) incorporates the Iran shock; if the nowcast drops below 2.0% in the next two weeks, recession risk becomes a primary market narrative alongside stagflation.

Gas Prices Jump 11 Cents Overnight — Consumer Inflation Shock Arrives at the Pump (AAA, March 3, 2026)

What they’re saying:The average price for a gallon of gasoline in the United States jumped 11 cents overnight — from approximately $3.00 to $3.11/gallon — the fastest single-day increase since the 2022 Russian invasion of Ukraine. Analysts project that if WTI crude stays near $77-80/bbl, gas prices could reach $3.50-$3.75/gallon within 2-3 weeks as refiners reprice futures-linked contracts. At $80 WTI sustained, some models project $4.00/gallon regional prices by April in high-cost states such as California.

The context:Gas prices are the most politically and economically visible inflation indicator for US consumers. An 11-cent overnight surge is front-page news for households and has immediate effects on consumer confidence and discretionary spending. The parallel is stark: in 2022, the Russian invasion drove gas to $5.01/gallon nationally and was a primary driver of Biden’s approval rating collapse. Trump’s DFC insurance and Navy escort announcement was partly designed to cap this consumer pain narrative. The transmission from WTI crude prices to pump prices typically takes 2-3 weeks, meaning the full impact of the current $77-80 WTI won’t be felt until mid-to-late March.

What to watch:Monitor GasBuddy and AAA daily gas price tracking; watch Trump’s comments on Strategic Petroleum Reserve (SPR) release — the US has not yet signaled a plan to tap reserves; if gas reaches $3.50 nationally, expect strong political pressure for SPR deployment.

G. WHAT’S NEXT -> TOP

UPCOMING THIS WEEK:

• Wednesday, March 4: ISM Services PMI (February) — critical read on services-sector price pressure and business activity; watch the Prices Paid subindex after manufacturing’s shock 70.5 reading

• Thursday, March 5: Weekly Initial Jobless Claims — labor market barometer; any spike above 220K would add a growth-shock narrative on top of the oil shock

• Friday, March 6: February Jobs Report (NFP + unemployment rate) — the week’s most critical data; will determine whether the Fed faces stagflation (strong jobs + rising oil) or a full growth scare (weak jobs + rising oil); consensus ~175K NFP

• Friday, March 6: February Trade Balance — will reflect pre-conflict import/export data, but expect significant revisions in the March report as Hormuz disruption flows through

• Ongoing: Iran-US conflict developments — ceasefire talks, naval escort deployment, tanker traffic resumption — are the dominant market catalyst for the week; watch US diplomatic back-channels through Oman (Iran’s traditional intermediary)

KEY QUESTIONS FOR NEXT 5-7 DAYS:

1. Will Trump’s Navy escort and DFC insurance announcement translate into actual tanker movement through the Strait within days — or will it prove to be market-calming rhetoric that fades if Iran refuses to allow passage?

2. Does Friday’s February jobs report show labor market weakness on top of the oil price shock — confirming stagflation — or does strong employment data force the Fed into an impossible position of holding rates while both growth and inflation deteriorate?

3. With rate cuts priced out for 2026 and the 10Y at 4.063%, which sectors that were pricing in 2026 rate relief (REITs, small-caps, homebuilders) face the largest earnings estimate cuts as the higher-for-longer regime is re-established?

Market Intelligence Brief (MIB) Ver. 14.19

For professional investors only. Not investment advice.

© 2026 RecessionALERT.com

MIB: US-Israeli Strikes Kill Iran’s Khamenei, Qatar LNG Halted, Oil Surges 8% — Dell’s AI Blowout and the Stagflation Trap

US-Israeli “Operation Roaring Lion” kills Khamenei; Iran drones shut Qatar’s LNG plant. Oil surges 8.3% to $72.57 as Hormuz fears grip markets. S&P 500 cut intraday losses to close flat; VIX +12% to 22.40. Airlines cratered: AAL -7.4%, CCL -10%. Energy and defense surged: XOM +4.7%, PLTR +6.6%. Dell soared 22% Friday on AI server blowout ($43B backlog). ISM Manufacturing beat at 52.4 — but Prices Paid hit 70.5, an inflation alarm.

TABLE OF CONTENTS

A. EXECUTIVE SUMMARY

B. MARKET DATA

C. HIGH-IMPACT STORIES (Minimum 5)

D. MODERATE-IMPACT STORIES (Minimum 5)

E. EARNINGS WATCH

F. ECONOMY WATCH

G. WHAT’S NEXT

A. EXECUTIVE SUMMARY -> TOP

MARKET SNAPSHOT:

The S&P 500 closed nearly flat at 6,881.62 (+0.04%) after a dramatic intraday reversal — the index plunged as much as 1.2% at the open before buyers returned as investors assessed the Iran conflict as potentially contained rather than immediately catastrophic. The Nasdaq edged up 0.36% as AI defense software names and energy technology stocks partially offset brutal losses in airlines and cruise operators; the Dow slipped 0.15% dragged by industrials and travel exposure. The session was dominated by geopolitical rotation: Energy surged more than 4%, Consumer Discretionary (airlines, cruises, hotels) cratered, and Defense rallied 3-6% — making this a war-trade rotation rather than a broad market directional move. 7 of 11 S&P sectors moved more than 1%, with only Utilities and Real Estate providing relative calm.

TODAY AT A GLANCE:

• “Operation Roaring Lion”: US-Israeli strikes killed Iran’s Supreme Leader Khamenei over the weekend; Iran launched retaliatory drone strikes across 9 Middle East nations including Saudi Arabia, Qatar, UAE, and Bahrain

• Energy supply shock: WTI crude surged 8.3% to $72.57; Iranian drones struck Qatar’s Ras Laffan complex, halting 20% of global LNG supply; Hormuz traffic fell 80% below 7-day average

• Airlines/travel obliterated: AAL -7.4%, UAL -6.0%, DAL -5.2%; Cruise lines worse — CCL -10.1%, NCLH -9.0%; energy costs + geopolitical risk a double hit

• Defense/energy bid: XOM +4.7%, COP +5.1%, PLTR +6.6%, LMT +3.4%, RTX +4.3%; gold hit record $5,393 (+2.1%) as safe haven demand surged

• Dell (DELL) +22% Friday: AI server blowout — $9B in AI server revenue (+342%), $43B order backlog; FY27 guidance well ahead of consensus; markets carried the gain into Monday

• Inflation alarm: ISM Manufacturing PMI beat at 52.4 (vs. 51.8 est.) but the Prices Paid component exploded to 70.5 from 59.0 — the sharpest one-month inflation reading in manufacturing in over a year, compounded by the oil shock

KEY THEMES:

1. The Iran War Trade Is Pricing a Multi-Week Conflict — Oil up 8%, gold up 2%, airlines down 7%, cruise lines down 10%, defense up 4-6%, VIX at 22.40 (+12%): this is not a one-day spike. The Strait of Hormuz traffic collapse, Qatar LNG shutdown, and sustained safe haven demand suggest the risk premium will persist and widen if Iran-US hostilities escalate further. Goldman Sachs is already projecting $100-$150 oil in a prolonged conflict.

2. Stagflation Risk Has Returned With Force — Oil at $72 (from $65 last week) combined with the 15% Section 122 universal tariff and an ISM Prices Paid reading of 70.5 creates a toxic inflationary cocktail. The Fed is trapped: it cannot cut rates into a commodity shock, and slowing growth from high energy costs limits its options. Any Hormuz closure could push this from tail-risk to base-case within days.

3. AI Infrastructure Spending Is War-Proof — Dell’s $43B AI server backlog and Palantir’s +6.6% on a war-day show that the AI defense spending cycle is accelerating, not pausing. Block’s 40% workforce cut bet on AI productivity is the corporate corollary: the AI capex boom continues regardless of geopolitics, and the companies supplying it (and using it to cut costs) are being rewarded.

B. MARKET DATA -> TOP

CLOSING PRICES – Monday, March 2, 2026:

MAJOR INDICES

| Index | Close | Change | % Change | Why It Moved |

|---|---|---|---|---|

| S&P 500 | 6,881.62 | +2.73 | +0.04% | Rebounded from -1.2% low; energy/defense gains offset travel/airline collapse; buy-the-dip after Iran conflict opened session sharply lower |

| Dow Jones | 48,904.78 | -73.14 | -0.15% | Industrial and travel components dragged; Boeing, Caterpillar, and airline-adjacent names weighed on the blue-chip index |

| Nasdaq | 22,748.86 | +81.96 | +0.36% | Defense AI stocks (PLTR +6.6%) and energy tech lifted the index; Dell’s AI server blowout carried into Monday; megacap tech resilient |

| Russell 2000 | 2,643.52 | +11.16 | +0.42% | Small-cap energy and domestic defense contractors led; less international exposure insulated vs. large-cap travel exposure |

| NYSE Composite | 22,570.82 | +139.37 | +0.62% | Broad NYSE energy exposure (XOM, CVX, COP all up 3-5%) aided the composite more than the cap-weighted S&P |

VOLATILITY & TREASURIES

| Instrument | Level | Change | Why It Moved |

|---|---|---|---|

| VIX | 22.40 | +2.40 (+12.0%) | Broke above the psychologically significant 20 level; Iran war risk and Hormuz uncertainty drove the fear gauge to its highest since early 2026 |

| 10-Year Treasury Yield | 4.05% | +3 bps | Oil-driven inflation fears outweighed safe-haven bond demand; ISM Prices Paid at 70.5 reinforced the inflationary read; yields defied typical war-flight pattern |

| 2-Year Treasury Yield | 3.74% | +5 bps | Stagflation concerns — oil shock + tariff inflation — pushed short rates up as markets pushed back Fed cut expectations; front-end sensitive to inflation repricing |

| US Dollar Index (DXY) | 98.00 | +0.30 (+0.31%) | 5-week high; dollar benefited from safe-haven demand despite inflation risk; investors chose USD over EM currencies and crypto as geopolitical hedge |

COMMODITIES

| Asset | Price | Change | % Change | Why It Moved |

|---|---|---|---|---|

| Gold | $5,392.77/oz | +$111.22 | +2.1% | New all-time high; geopolitical war risk + stagflation fears drove institutional safe haven demand; gold extended its 7-month winning streak |

| Silver | $94.26/oz | +$3.76 | +4.2% | Following gold’s safe haven bid; industrial metal demand from defense sector added a secondary layer of buying interest |

| Crude Oil (WTI) | $72.57/bbl | +$5.55 | +8.3% | Biggest single-day surge in months; Strait of Hormuz traffic collapsed 80%; Qatar LNG shutdown; Aramco refinery hit by drone strike; analysts warned of $100+ if conflict persists |

| Natural Gas | $2.954/MMBtu | +$0.10 | +3.5% | US futures rose in sympathy with global gas; Qatar’s LNG shutdown (20% of global supply) created immediate shortfall fears; European gas surged 40-50% |

| Bitcoin | $66,082 | -$748 | -1.1% | Lost the safe-haven battle to gold decisively; risk-off flows and the Iran conflict underlined that BTC is not a war hedge; crypto failed its “digital gold” test |

TOP LARGE-CAP MOVERS:

Selection criteria: US-listed companies with market cap above $25 billion that moved ±1.5% or more during the session. Movers are ranked by percentage change and capped at 5 gainers and 5 decliners. On muted trading days when fewer than 3 names meet the threshold, the largest moves are shown regardless. Moves driven by earnings, M&A, analyst actions, sector rotation, or macro catalysts are prioritized over low-volume or technical moves.

GAINERS

| Company | Ticker | Close | Change | Why It Moved |

|---|---|---|---|---|

| Palantir Technologies | PLTR | $146.05 | +6.60% | AI defense software supplier; Iran conflict raised demand expectations for US government AI/intelligence contracts; Bank of America raised price target to $255 |

| ConocoPhillips | COP | $98.83 | +5.10% | Oil price surge on Hormuz fears lifted all US energy producers; COP has lower Middle East exposure vs. integrated majors, seen as relatively clean beneficiary |

| Exxon Mobil | XOM | $159.61 | +4.70% | Jumped to intraday record; oil shock directly reprices near-term cash flow; Exxon’s US shale operations insulate it from Middle East supply disruption |

| RTX Corp | RTX | $130.44 | +4.30% | Raytheon missile defense systems front and center as Iran launched drone/missile attacks across the region; defense budget expansion expected |

| Lockheed Martin | LMT | $693.27 | +3.40% | Iran conflict highlighted F-35 and missile defense demand; Operation Roaring Lion showcased US precision weapons systems that LMT supplies |

DECLINERS

| Company | Ticker | Close | Change | Why It Moved |

|---|---|---|---|---|

| Carnival Corp | CCL | $28.36 | -10.11% | Double hit: surging fuel costs (oil +8%) crushes margins + Iran threatening Strait of Hormuz spooked Mediterranean/Gulf itinerary bookings; touched intraday low of $27.90 |

| Norwegian Cruise Line | NCLH | $17.44 | -9.00% | Same dynamics as CCL; Norwegian has higher leverage and thinner margins, amplifying the sell-off; cancellation risk for Middle East itineraries priced in |

| American Airlines | AAL | $14.50 | -7.40% | Highest fuel cost sensitivity of the US majors; Middle East route suspension fears; unhedged fuel position makes AAL most exposed to oil spike |

| United Airlines | UAL | $89.10 | -6.00% | Most international exposure of US carriers; analysts flagged transatlantic and Asia routes running over Middle East airspace as highest disruption risk |

| Ford Motor | F | $13.39 | -5.00% | 4.4 million vehicle recall announced today (trailer module software defect); volume 70% above 3-month average; quality overhang adds to investor concern |

C. HIGH-IMPACT STORIES -> TOP

BEARISH

1. US-Israeli “Operation Roaring Lion” Kills Iran’s Khamenei; Tehran Retaliates Across 9 Countries

The core facts:US and Israeli forces launched coordinated strikes on Iran over the weekend, killing Supreme Leader Ayatollah Ali Khamenei and top security officials in what both governments dubbed “Operation Roaring Lion.” President Trump confirmed combat operations are ongoing and could last “four weeks or less,” acknowledging three US troops were killed. Iran retaliated with drone and missile strikes targeting US military and allied assets across nine Middle East nations, including Saudi Arabia, Qatar, UAE, Kuwait, Bahrain, Jordan, Iraq, and Oman. Insurers have already raised tanker premiums for the Strait of Hormuz.

Why it matters:The death of Iran’s supreme leader is a geopolitical inflection point on par with the 1979 revolution. For US markets, the primary transmission is energy: Iran is an OPEC member, the Strait of Hormuz carries a third of global seaborne crude, and any sustained closure is — per energy analysts — “a guaranteed global recession.” Secondary impacts hit airlines (fuel costs, route disruptions), defense contractors (weapons demand surge), and broader risk appetite via the VIX. Markets partially recovered from opening lows on hopes the conflict stays contained, but the base case is now multi-week US military engagement in the Gulf.

What to watch:Trump’s daily operational briefings for signs of escalation vs. ceasefire; whether Iran’s new leadership signals willingness to negotiate; Strait of Hormuz tanker traffic data (currently down 80% from 7-day average). Any confirmed closure would move the S&P 500 to the 6,000 level in Goldman’s worst-case model.

BEARISH

2. Iran Drones Strike Qatar’s Ras Laffan Complex: World’s Largest LNG Plant Halts Production

The core facts:Qatar’s Defense Ministry confirmed Iranian drone attacks struck QatarEnergy’s Ras Laffan Industrial City and Mesaieed Industrial City, forcing a complete halt of LNG production on March 2. QatarEnergy is the world’s single largest LNG producer, supplying approximately 20% of global LNG. European gas prices surged 39-50% on the news; Asian LNG benchmark prices jumped 39%. Saudi Arabia’s Ras Tanura refinery — one of the world’s largest diesel refineries — also sustained a drone strike and was taken offline.

Why it matters:This is a direct physical supply shock to global energy markets, not just a “fear premium.” Removing 20% of world LNG supply immediately affects European energy security (which has no easy US LNG substitute at this volume), Asian manufacturing competitiveness, and US natural gas export pricing. For US investors, this reprices utility costs, LNG export terminal operators (Cheniere Energy, Venture Global), and industrial energy consumers. Goldman Sachs projects Brent could reach $80-90 in days and $100-150 if the conflict persists — levels that historically trigger US recessions.

What to watch:QatarEnergy’s timeline to restart operations; whether Iran strikes additional Gulf energy infrastructure; Cheniere Energy (LNG) and Venture Global (VG) share prices as US LNG exporters gain pricing power; European TTF natural gas futures as the leading indicator of global energy stress.

BEARISH

3. WTI Oil Surges 8.3% to $72.57 as Strait of Hormuz Traffic Collapses 80%; Goldman Eyes $100-$150

The core facts:WTI crude oil surged $5.55 to $72.57 per barrel, its largest single-day gain in months; Brent jumped $6.54 to $79.41. Strait of Hormuz tanker traffic fell 80.8% below its 7-day average on March 1 as tankers pile up on both sides of the critical chokepoint. More than 14 million barrels per day normally flow through the Strait — a third of global seaborne crude. Iranian officials have publicly threatened to close the Strait. Tanker insurance premiums spiked immediately. Goldman Sachs estimates oil could reach $120-150 in a full-scale prolonged conflict.

Why it matters:An $8 one-day oil spike is a tax on every consumer and business in America. Each $10 rise in WTI adds roughly 25 cents to retail gasoline prices within 2-4 weeks. The political risk is acute: Trump’s approval rating fell sharply when Biden-era gas prices rose — the same dynamic could hamper the GOP in 2026 midterms. Beyond politics, high energy costs compress margins for airlines, trucking, manufacturing, and retail, and restoke CPI inflation just as tariffs are already pushing prices up. A $100 oil scenario would almost certainly tip the US economy into recession.

What to watch:WTI above $80 would signal markets are pricing a prolonged Hormuz disruption (not just fear premium); weekly EIA crude inventory report (Wednesday) for early demand destruction signals; retail gasoline price trackers for consumer impact timing.

BEARISH

4. Airlines and Cruise Lines Obliterated by Iran War Risk: AAL -7.4%, UAL -6%, CCL -10%, NCLH -9%

The core facts:US airlines suffered their worst single-day performance since the early COVID era. American Airlines (AAL) dropped as much as 7.4%, United Airlines (UAL) fell 6%, and Delta (DAL) was down more than 5%. Cruise lines were hit even harder: Carnival Corp (CCL) collapsed 10.1% to $28.36 (intraday low $27.90) and Norwegian Cruise Line (NCLH) plunged 9%. Royal Caribbean (RCL) shed about 4%. Hotel and resort names with Middle East exposure also declined. Combined, the travel sector lost tens of billions in market cap in a single session.

Why it matters:Airlines and cruise lines face a simultaneous dual shock: fuel cost explosion (jet fuel typically 20-25% of airline operating costs) and demand risk from travel disruption. Airlines with unhedged fuel positions (AAL) are most exposed; UAL’s heavy international network raises route closure risk. For cruise lines, fuel is the largest single operating cost, and CCL specifically cited fuel tailwinds in recent earnings — those are now headwinds. If oil stays above $75, consensus earnings estimates for all three US airline majors need to be cut materially. This is a sector-level earnings revision risk, not just a one-day trade.

What to watch:IATA (international air transport body) guidance on Middle East airspace closures; Carnival’s next investor update on fuel hedging and booking cancellation data; WTI price trajectory as the leading indicator for sector earnings cuts.

UNCERTAIN

5. ISM Manufacturing PMI Beats at 52.4 for Second Straight Month — But Prices Paid Explodes to 70.5

The core facts:The February ISM Manufacturing PMI printed 52.4% today, above the 51.8 consensus estimate and down slightly from January’s 52.6. This marks the second consecutive month of manufacturing expansion and only the third expansionary reading in 40 months. New Orders (55.8%) and Production both remained in expansion. However, the Prices Paid Index — a forward-looking inflation gauge — surged from 59.0 in January to 70.5 in February, the sharpest one-month acceleration in over a year, driven by Section 122 tariff pass-throughs and today’s oil shock layering on top.

Why it matters:The headline beat is genuinely good news — US manufacturing is expanding for the first time in years. But the Prices Paid reading of 70.5 is an acute stagflation signal. Historically, PMI Prices Paid above 65 correlates with core goods CPI reacceleration within 2-3 months. Combined with today’s oil shock, this makes the Fed’s next move impossible to predict: cutting would fan inflation, holding creates growth risk as higher costs squeeze margins. Before today’s oil news, this data would have simply been “good growth but tariff-driven inflation.” Post-Iran strikes, it’s a critical data point in the stagflation case.

What to watch:March ISM PMI release (first Monday of April); February CPI print (expected mid-March) for confirmation that Prices Paid inflation is passing through to consumers; Fed officials’ language at upcoming speaking engagements for their read on the oil-tariff inflation combination.

D. MODERATE-IMPACT STORIES -> TOP

BULLISH

6. US Energy Majors Surge as War Premium Reprices Sector: XOM +4.7%, COP +5.1%, CVX +3%

The core facts:Exxon Mobil jumped 4.7% to $159.61, touching an intraday record high. ConocoPhillips rallied 5.1% to $98.83. Chevron advanced more than 3%. The entire S&P 500 Energy sector gained approximately 4-5%, making it the best-performing sector of the session by a wide margin. US-based exploration and production companies were particularly favored as investors reasoned that a Middle East supply shock benefits US shale producers who face no direct operational risk from the conflict.

Why it matters:The war premium directly translates to cash flow for US energy majors. At $72 WTI vs. ~$65 last week, Exxon generates roughly $500M in additional quarterly free cash flow per $5/barrel increase. This repricing is not just speculative — Goldman’s $100-150 oil scenario, if it materializes, would make US majors the most valuable sector in the S&P 500 by wide margin. The inverse relationship between energy sector gains and the rest of the market is important: this is a zero-sum rotation, not a rising tide, and it compresses multiples across every oil-intensive sector.

What to watch:If WTI closes above $80, expect Wall Street to issue formal earnings upgrades for the entire energy sector; monitor XOM and COP Q1 earnings calls in late April for management guidance on the war premium’s durability.

BULLISH

7. Defense Stocks Rally on “Operation Roaring Lion”: LMT +3.4%, RTX +4.3%, NOC +5.8%, PLTR +6.6%

The core facts:Defense primes surged as the US-Iran war showcased demand for precision weapons, missile defense, and AI-enabled surveillance. Lockheed Martin (LMT) gained 3.4%, RTX Corp (RTX) climbed 4.3%, and Northrop Grumman (NOC) rose 5.8%. Palantir Technologies (PLTR) surged 6.6% as its AI-enabled intelligence software for US government operations gained high visibility in the conflict context. Bank of America raised its PLTR price target to $255 per share today. Smaller defense tech names surged further: Kratos Defense jumped 9.6% intraday.

Why it matters:Defense spending bills lag combat operations by 6-18 months, but investor pricing is forward-looking. Every day of US military engagement in the Gulf strengthens the case for defense budget expansion in the FY2027 appropriations cycle. Palantir’s inclusion in this rally is particularly notable — it signals that AI defense software is now classified as critical military infrastructure by the market, not just a government services contractor. The Lockheed/RTX/NOC rally reflects expected weapons resupply orders following precision strike campaigns.

UNCERTAIN

8. Gold Hits Record $5,393 (+2.1%), Silver Surges 4.2%: War-Driven Safe Haven Demand Intensifies

The core facts:Gold settled at $5,392.77 per ounce, a new all-time high, extending its remarkable 7-month consecutive monthly winning streak. Silver rose 4.2% to $94.26. The safe haven bid was particularly noteworthy because it defied the typical inverse relationship with US Treasury bonds — bonds barely moved while gold surged, suggesting gold is being bought as inflation protection as much as war hedge. Bitcoin, by contrast, fell 1.1%, definitively losing the “digital gold” narrative on this geopolitical shock day.

Why it matters:Gold’s continued advance to new highs while Bitcoin falls in a geopolitical crisis is a significant data point for the “store of value” debate. More practically, gold at $5,393 represents a 22% return in 2026 alone and is well ahead of analyst forecasts of $5,400 average for the full year — those forecasts may need to be revised higher. For portfolio managers, gold’s outperformance over Treasuries as a crisis hedge signals that institutional buyers are more concerned about inflation than deflation from the Iran shock.

What to watch:A decisive close above $5,400 would trigger institutional momentum flows and new analyst price target upgrades for gold miners; watch GDX (gold miners ETF) for amplified plays on continued gold strength.

BEARISH

9. Ford Motor Discloses 4.4 Million Vehicle Recall Over Trailer Module Software Defect; Shares Fall 5%

The core facts:Ford Motor (F) disclosed a recall covering approximately 4.4 million US vehicles over an integrated trailer module software defect that can cause trailer lights to fail and, in certain configurations, affect trailer braking systems. Shares fell 5.0% to $13.39 on volume roughly 70% above the three-month average, signaling the recall exceeded investor expectations in scope. The recall spans multiple model years of F-150, F-250, F-350, and other tow-capable vehicles — Ford’s most profitable truck franchise.

Why it matters:A 4.4 million vehicle recall signals ongoing quality execution challenges at Ford. The affected vehicles are disproportionately from Ford’s most profitable truck lineup — F-series pickups drive the majority of Ford’s operating income. Recall costs (parts, labor, dealer compensation) can run hundreds of dollars per vehicle; at this scale the total cost could approach $500M-$1B. Beyond direct financial impact, repeated recalls compound reputational damage with truck buyers who have alternatives (GM’s Silverado, RAM). The recall comes as Ford is already navigating EV transition costs and tariff headwinds.

What to watch:Ford Q1 2026 earnings (expected late April) for management update on total recall costs and impact to free cash flow guidance; NHTSA investigation timeline for any safety escalation.

BEARISH

10. European Parliament Freezes US Trade Deal Vote; Section 122 Tariffs Generate Retaliatory Risk

The core facts:The European Parliament voted Monday to postpone a scheduled vote on a trade deal with the United States, citing the ongoing 15% universal global tariff imposed by the Trump administration under Section 122 of the Trade Act of 1974. The US Section 122 tariff — enacted February 24 after the Supreme Court struck down IEEPA-based tariffs on February 21 — represents the largest tariff regime since Smoot-Hawley. The EU move signals that allied trade relationships are now being reassessed, with European officials publicly linking the tariff regime to geopolitical burden-sharing.

Why it matters:The EU is America’s largest trading partner; a trade freeze at this moment — when the US also needs European allies’ cooperation for the Iran operation — creates a compound geopolitical-economic risk. The immediate transmission to US markets is through multinational earnings: S&P 500 companies with high European revenue exposure (think luxury goods, autos, semiconductors exported to Europe) face retaliatory tariff risk. The timing is particularly toxic: the 15% universal tariff is already pushing ISM Prices Paid higher, and a full EU trade response would add another inflationary layer.

What to watch:EU Parliament rescheduled vote date; whether the US-Iran conflict softens EU’s trade stance (as it did during the post-9/11 period); next USTR statement on Section 122 negotiations.

E. EARNINGS WATCH -> TOP

Selection criteria: This section covers only market-moving earnings from large-cap companies (>$25B market cap) with sector significance or systemic implications. The S&P 500 scorecard above tracks all 500 index components, but individual stories below focus on names large enough to move markets and provide economic signals relevant to US large-cap portfolio managers. On any given day, 30-80+ companies may report earnings, but MIB filters for the 2-5 names most relevant to institutional investors.

FRIDAY AFTER THE BELL (Markets Reacted Today)

BULLISH

11. Dell Technologies (DELL): +22% | AI Server Blowout Redefines the Infrastructure Bull Case

The Numbers:Q4 FY2026 revenue: $33.4B, +39% YoY (massive beat). Non-GAAP EPS: $3.89 (beat consensus). AI-optimized server revenue: $9B in the quarter, +342% YoY. Full-year FY2026 revenue: $113.5B, +19%; annual non-GAAP EPS: $10.30, +27%. FY2027 guidance: $138-142B revenue (23% growth at midpoint), EPS ~$12.90 — both well ahead of analyst expectations. Released: Friday, February 27, AMC.

The Win:Dell entered FY2027 with a record $43 billion AI server backlog — up from $34B booked during the quarter — meaning AI infrastructure demand is accelerating faster than Dell can ship. The 342% growth in AI server revenue is not a comparison to a weak prior-year period; it’s absolute surge driven by hyperscaler and enterprise AI buildout. Dell is also benefiting from AI-related demand for storage and networking (traditional server segment +27%).

The Ripple:DELL’s blowout reinforces the AI infrastructure spending cycle, lifting semiconductor and server component names (NVDA, AMD, Marvell, Broadcom). HPE — Dell’s closest direct competitor — traded up in sympathy. The report raises expectations materially for Broadcom’s earnings this week (Thursday AMC), which will be closely watched for AI chip demand confirmation.

What It Means:Dell has definitively pivoted from a mature PC/server business into the center of the AI infrastructure boom. At $43B in AI backlog vs. ~$9B quarterly revenue, there are 4+ quarters of visibility ahead. For portfolio managers, DELL is now an AI proxy stock with infrastructure diversification — and its blowout means AI capex cycle concerns are premature.

What to watch:Broadcom (AVGO) earnings Thursday, March 5 AMC — the next major AI infrastructure data point; any supply constraint commentary from Dell management given memory shortage headwinds.

UNCERTAIN

12. Block Inc. (XYZ): +20% | 40% Workforce Slash + Raised Guidance Ignites AI Restructuring Trade

The Numbers:FY2025 revenue: $24.19B; net income: $1.31B. 2026 gross profit target: $12.2B. Raised 2026 non-GAAP EPS guidance to $3.66 vs. $3.22 prior consensus. Restructuring charges: $450-500M. Workforce reduction: ~4,000 positions eliminated (from 10,000+ to below 6,000 — a 40% cut). Released: Thursday, February 26, AMC; stock reacted +20% on February 27. Note: Block Inc. now trades under ticker XYZ (formerly SQ).

The Win/Problem:CEO Jack Dorsey framed the cuts explicitly as an “AI bet” — saying Block can do more with fewer people because AI tools now handle tasks that previously required headcount. The raised EPS guidance reflects the structural cost savings. The uncertainty: a 40% workforce cut is either transformative efficiency or a sign of business model stress. The market initially rewarded the move, but $450-500M in restructuring charges will weigh on reported earnings in coming quarters.

The Ripple:Dorsey explicitly warned that “most companies will make similar cuts in the next year.” This is the most prominent CEO voice to date predicting a broad AI-driven workforce displacement wave. Other fintech names moved higher on the AI cost-efficiency narrative; incumbent bank stocks were roughly flat as investors weigh the fintech disruption angle.

What It Means:Block’s restructuring is the clearest real-world data point yet that AI is actively replacing knowledge workers, not just augmenting them. For investors, the key question is whether the raised guidance is achievable — companies that cut deeply and miss revenue targets get punished severely. Watch the first two quarters post-restructuring for revenue trajectory.

What to watch:Q1 2026 results (due late April/May) for revenue stability post-cuts; whether other fintech/tech companies follow with similar AI-driven workforce reductions; Congressional reaction to the scale of AI-driven layoffs.

TODAY BEFORE THE BELL (Markets Already Reacted)

No major earnings before the bell from companies with >$25B market cap.

TODAY AFTER THE BELL (Markets React Tomorrow)

UNCERTAIN

13. MongoDB (MDB): Stock Plunges in After-Hours Despite 79% EPS Beat — Guidance Misses Elevated Bar

The Numbers:Q4 FY2026 revenue: $695.1M, +27% YoY (beat). Non-GAAP EPS: $1.65 vs. $0.92 consensus estimate (massive beat, 79% above estimate). Full-year FY2026 revenue: $2.46B, +23%. Q1 FY2027 revenue guidance: $659-664M vs. $661.94M consensus (roughly in-line). Q1 FY2027 non-GAAP EPS guidance: $1.15-1.19 vs. $1.21 estimate (slight miss). Stock fell approximately 12% in after-hours on the guidance shortfall despite the strong quarterly results. Released: Monday, March 2, AMC (5:00 p.m. ET conference call).

The Problem:MongoDB’s massive EPS beat should have been rewarded. The crash reflects elevated expectations: MDB stock had run significantly into the report on AI database demand optimism. Any guidance that wasn’t dramatically above consensus — even “roughly in-line” — disappointed investors who had priced in upside. The slight EPS guidance miss suggests management is being conservative, but in a high-multiple stock that requires execution to justify valuation, that’s interpreted as a warning sign.

The Ripple:MongoDB is often used as a proxy for enterprise software and cloud database spending. A MDB selloff on missed guidance can pressure peers including Snowflake, Elastic, and Redis-adjacent names. The reaction also highlights a broader theme: AI-adjacent software companies are now held to a “beat and raise” standard; meeting expectations is no longer sufficient.

What It Means:MDB’s post-earnings crash is a risk-management signal for high-multiple enterprise software: the bar has been raised by AI hype, and companies that beat operationally but fail to materially raise guidance will be sold. The stock is likely to create a buying opportunity if Tuesday’s session overreacts.

What to watch:MDB’s Tuesday open for the extent of the after-hours damage; analyst note revisions in the first 24 hours for the consensus view on whether this is a buy-the-dip or a trend shift; CrowdStrike (CRWD) earnings Tuesday AMC as another high-multiple software bellwether.

WEEK AHEAD PREVIEW:

Tuesday, March 3: CrowdStrike (CRWD) AMC — the first major cybersecurity earnings of the quarter; particularly significant in the context of the Iran conflict and elevated cyber threat environment. Wednesday, March 4: Alibaba (BABA) BMO — China e-commerce giant provides read on global demand and US-China trade tensions under the tariff regime. Thursday, March 5: Broadcom (AVGO) AMC — the most important AI semiconductor earnings of the week; $1.5T market cap company; will confirm or challenge Dell’s AI demand narrative. Costco (COST) AMC — US consumer health bellwether. Friday, March 6: No major earnings expected.

F. ECONOMY WATCH -> TOP

Tracking U.S. economic indicators and commentary from the past 3 days.

ISM Manufacturing Prices Paid Surges to 70.5 — Tariff-Driven Inflation Alarm Hits Manufacturing (ISM, March 2, 2026)

What they’re saying:Today’s ISM Manufacturing PMI report showed that while headline activity expanded for the second consecutive month (52.4%), the Prices Paid Index surged from 59.0 in January to 70.5 in February — the sharpest one-month acceleration in over a year. ISM Chair Susan Spence noted that tariff pass-throughs are “clearly visible” in the input cost data, with multiple survey respondents specifically citing the 15% Section 122 universal tariff and steel/aluminum duties as the primary drivers.

The context:An ISM Prices Paid reading above 65 has historically correlated with core goods CPI reacceleration of 0.3-0.5% within 60-90 days. The last time Prices Paid hit 70+ was during the 2021-2022 tariff/supply-chain inflation cycle, which ultimately pushed CPI above 9%. Today’s oil shock (WTI +8.3%) is now layered on top of an already elevated pricing environment. The Fed’s inflation mandate and its growth mandate are pointing in opposite directions simultaneously — Prices Paid at 70.5 argues strongly against any near-term rate cuts.

What to watch:February CPI (due mid-March) for the consumer-level inflation read; February PPI (due mid-March) for producer price confirmation; next Fed speak for officials’ response to Prices Paid surge combined with oil shock.

Iran War Oil Shock Creates Recession Flashpoint: Goldman Sees $100-$150 Oil, Oxford Economics Issues Formal Warning (Multiple sources, March 1-2, 2026)

What they’re saying:Goldman Sachs issued a note projecting Brent crude could reach $120-150 per barrel in a “full-scale prolonged conflict” scenario, representing a 60-90% increase from pre-conflict levels. Oxford Economics published a formal scenario analysis titled “The 2026 Iran War: An Initial Take and Implications,” flagging that a 60-day Strait of Hormuz closure would reduce global GDP by 2.1% — enough to tip Europe and parts of Asia into recession. Multiple analysts warned that a $100 oil shock translates historically to a 16% S&P 500 correction and GDP growth deceleration of 1.5-2.0 percentage points within 12 months.

The context:The US economy was running at GDPNow 3.0% Q1 2026 entering this week (before today’s oil shock). Historical analysis of oil shocks shows that a $30-40/barrel increase over 3 months (plausible in the Goldman scenario) is sufficient to shave 1-1.5% from annual GDP growth. Combined with the existing tariff inflation headwind, the economy faces a supply-shock squeeze that historically either forces the Fed to raise rates (recession trigger) or accept higher inflation (erosion of purchasing power).

What to watch:Strait of Hormuz reopening timeline is the single most important variable for the recession risk assessment; Brent crude above $85 would trigger formal recession probability upgrades from major banks; February nonfarm payrolls (Friday, March 6) will be the first major labor data point under the new oil shock environment.

Atlanta Fed GDPNow Q1 2026 Tracking at 3.0% — Solid Pre-Conflict Baseline, But Durability in Question (Atlanta Fed, February 27, 2026)

What they’re saying:The Atlanta Fed’s GDPNow model estimated Q1 2026 real GDP growth at 3.0% annualized as of February 27 (the most recent update), down modestly from 3.1% on February 24. The model cited slight reductions to both real gross private domestic investment (+7.9% from +8.5%) and government expenditures (+1.5% from +1.6%). The next scheduled GDPNow update is today, March 2, and will incorporate today’s ISM Manufacturing data — likely pushing the estimate slightly higher on the headline PMI beat before the oil shock data can be incorporated.

The context:A 3.0% GDPNow estimate heading into the Iran conflict is a meaningful cushion — the economy was genuinely healthy. However, GDPNow is a backward-looking nowcast of current-quarter data; it cannot capture the oil shock that began over the weekend. The relevant forward question is whether the $7+/barrel oil spike and Qatar LNG shutdown will materially slow Q1 consumer spending and business investment. Historical oil shocks of similar magnitude typically take 4-6 weeks to show up in hard economic data.

What to watch:Next GDPNow updates throughout March as retail sales, consumer spending, and business investment data are released; March 6 nonfarm payrolls for the first comprehensive labor read of Q1 2026.

G. WHAT’S NEXT -> TOP