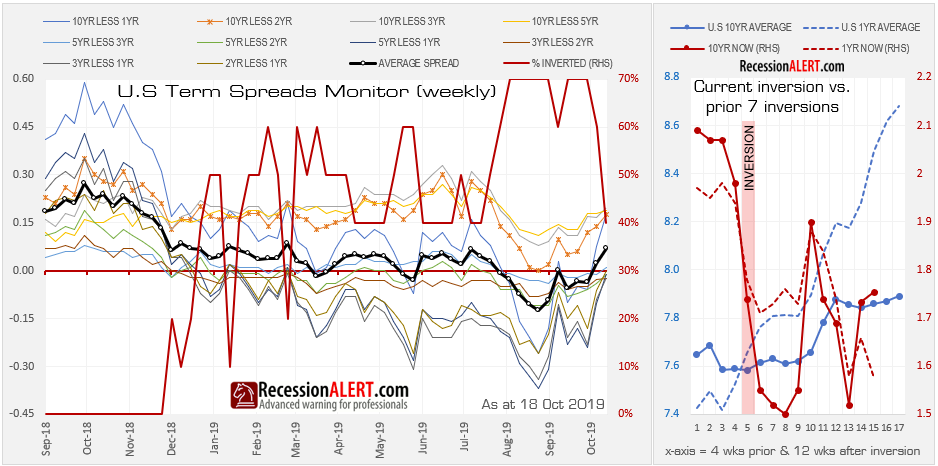

The RecessionALERT yield-curve aggregate and diffusion has just made a dramatic reversal, with the percentage of 10 term-spreads that are inverted dropping from 70% to 40%:

The 10YR less the 2YR narrowly averted an inversion 8 weeks ago and the 10YR-5YR and 10YR-3YR never came close to inversion. If one looks at the latest history and with the benefit of hindsight, we can see that the yield spread aggregate and its 10 components seems to be on a trend upwards. The 10YR-1YR has “un-inverted” 2 weeks ago and this week the 5YR-3YR and 2YR-1YR managed to raise their heads above water. All the other components are threatening an inversion reversal.

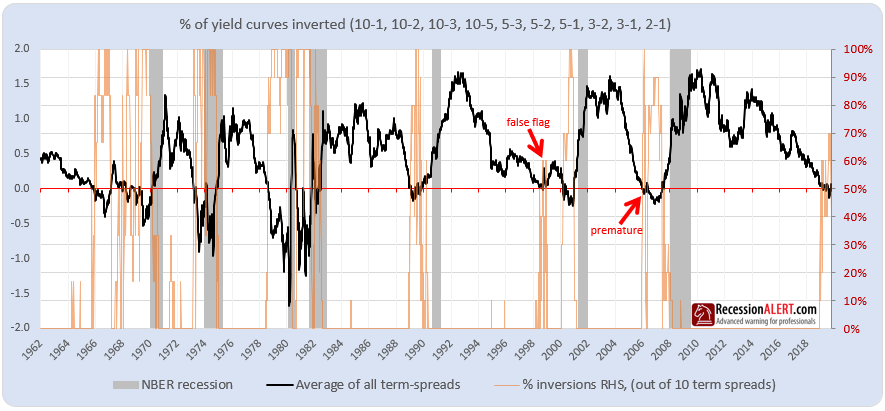

For quite some time now we have been warning that the yield inversion we were witnessing may be a false positive as witnessed in late 1998 or a premature inversion as witnessed in 2006. Not only was the depth and duration of the latest inversion weak, but the diffusion representing the percentage of underlying term spreads that have inverted failed to stretch beyond 70%:

But let us assume we are wrong – and recession does occur as predicted by the yield curve inversion. Due to the mild depth, duration and completeness of the inversion, coupled with the inversion resulting from longer rates falling faster than shorter rates as opposed to shorter rates rising faster than longer rates as is the historical norm, we are still inclined to assume that it is likely to be a mild recession.

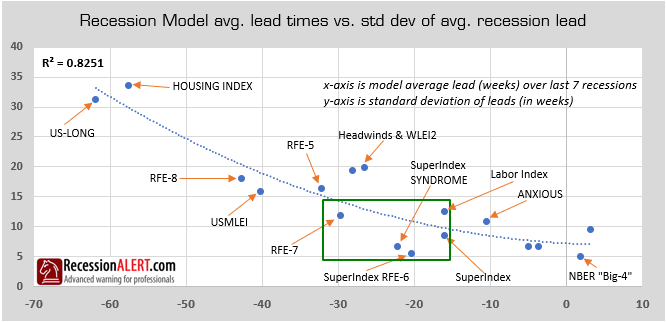

Again we would like to point out that the presence of many false positives on daily and weekly yield curve prints coupled with very long leads to recession and wide standard deviations on the average lead to recession can make basing market related actions on the yield curve less useful. At best the yield curve is a background signal. Below is a selection of RecessionALERT models with the yield curve characteristics very similar to the US-LONG category:

As prior research of ours has shown, getting out the stock market more than 5-6 months prior to recession is very counter-productive.

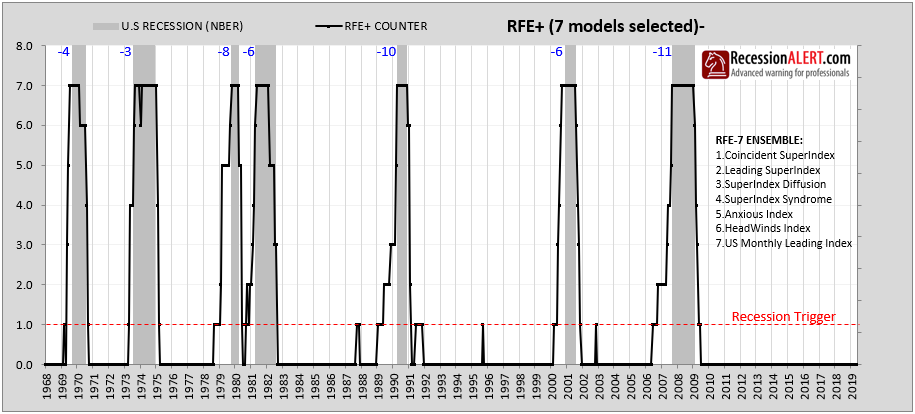

With the above in mind, its best to follow a battery of short-leading (20-30 weeks) indicators with very few or zero false positives and low standards of deviation in their lead times. The SuperIndex RFE-6 that is displayed in every weeks’ SuperIndex PDF report fits that bill perfectly. Adding the US Monthly Leading Index (USMLEI) to the RFE-6 ensemble, gives you the RFE-7 which also provides for zero false positives historically for signals greater than 1:

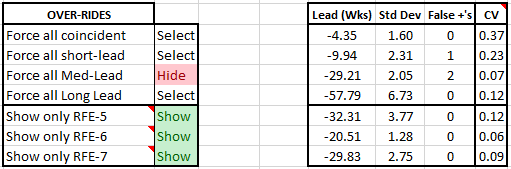

The ability to hard-wire RFE-5 (trigger =0), RFE-6 (trigger =1) and RFE-7 (trigger=1) into the monthly data-file will be made available from next months report in the OVER-RIDES input section as shown below:

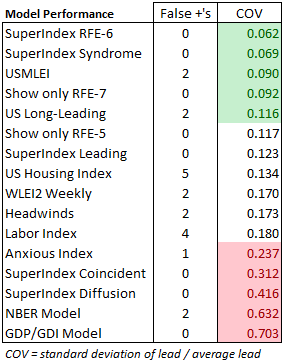

We have also added to the user selection section the average recession lead, standard deviation, false positive count and coefficient of variance (CV) statistics for every one of the 20 or so models we track. Ignoring false positives, if one takes the coefficient of variance as the main performance metric (lower=better) then here are the 5 most/least powerful RecessionALERT models:

The models in green are the most powerful ones when one measures the standard deviation (variance) of average historical lead times to recession as a percentage of the average lead to recession. RFE-6 and RFE-7 have zero false positives (triggers > 1), low CV’s and fit into that golden window of 20-28 weeks lead to recession (even accounting for reporting lags).

Comments are closed.