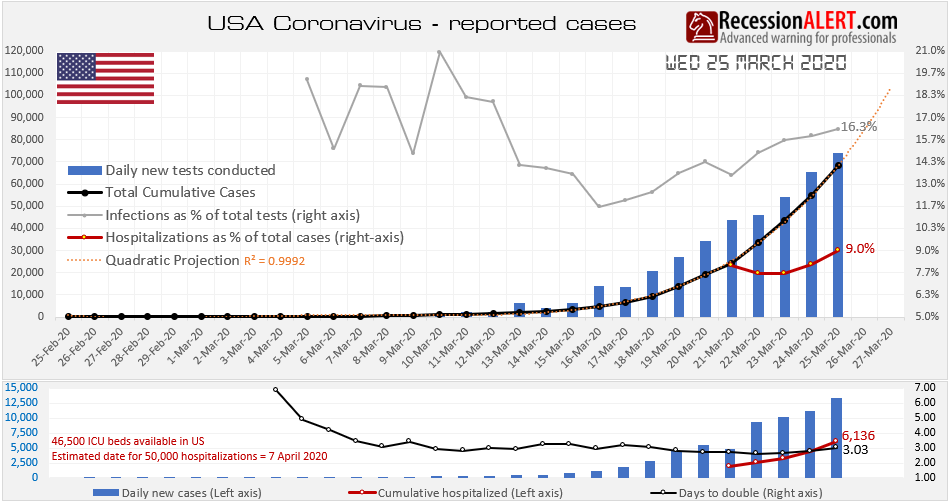

Businesses are going to be shuttered in massive numbers as the U.S has to deal with the unavoidable nationwide lock-down that will be required to contain the highly contagious Coronavirus. From our Covid19 Dashboard we maintain for our subscribers, we can see that the number of cases is rising according to a quadratic equation that will yield over 100,000 cases by the end of this week and over 500,000 cases by 7th April (assuming trends hold.)

Hospitalizations are running at 9% of cases and given that the U.S has an estimated 46,500 ICU beds (maybe double in a “wartime crises”) we estimate 50,000 hospitalizations by 7th April at which time the health system is going to be under severe strain.

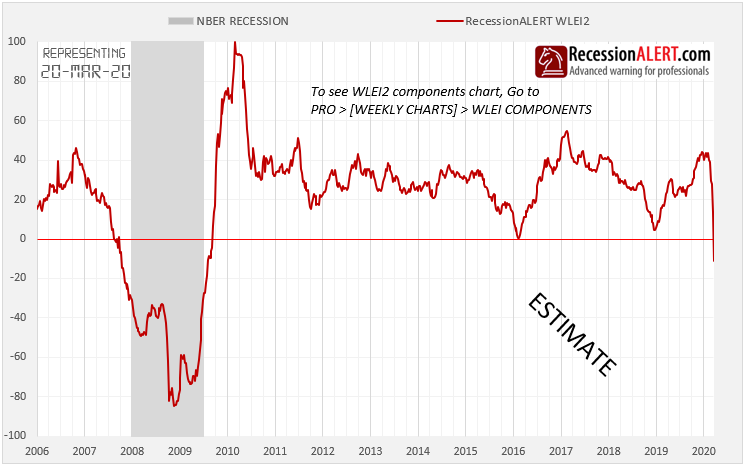

Notwithstanding the humanitarian crises, the unavoidable global and U.S lock-down is going to hurt the US growth story very badly and in very short order. We predict over 2 million unemployment claims will be filed this week which is going to decimate the upcoming WLEI print as our estimation below shows:

This will be the first recession trigger for the WLEI since the global financial crises and subsequent recession of 2008. The Weekly SuperIndex (which is a pseudo weekly index with weekly and monthly components) is likely to follow within 2-3 weeks after that.

As we have stated before, when we have a sudden and dramatic stoppage of all economic activity due to a humanitarian crises (or any other exogenous event) then precious few leading indicators will provide adequate warning especially if no financial imbalances were present to raise recessionary concerns in the first place.

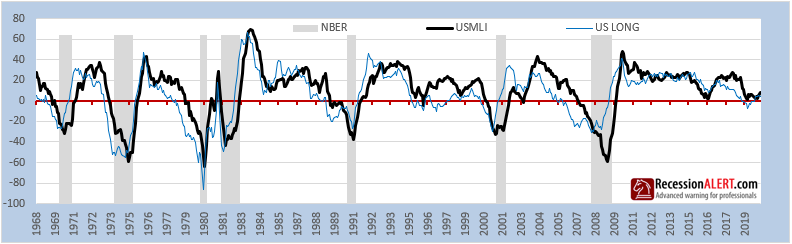

Apart from our Long Leading Indicator (US-LONG) in the US Monthly Leading Index report (depicted below)

…the only other warning we had was from the RAVI which warned in 2Q19 that the stock market was dangerously overvalued and started predicting negative returns ahead. As with most valuation based models, the over-exuberance could remain in place a lot longer than your short-positions could remain liquid, but what these valuation models DO provide is a danger signal for a fragile overvalued market that will not be able to handle an exogenous event. Lo and behold, we had an exogenous event against the backdrop of a highly overvalued market and the most brutal market collapse since the great depression ensued. But be clear that sans the Covid-19 exogenous event, the RAVI model could have had divergent forecasts with actual stock market outcomes for potentially much longer, since bear markets rarely commence based on valuation concerns alone.

Given the sudden stop of the economy, we are treating all our leading indicators as very-short to coincident economic indicators until further notice.

With most of the damage already done on the stock market (we could see another 10-15% down-leg, but RAVI is seeing upside so we are at least “moderately priced” now), we turn our eyes to using the leading indicators to anticipate a turnaround in the economy. One of these will be the stock market itself which in turn will be looking for signs of peak-infection in the US, and that is why we have focused charts for the US Covid-19 outbreak.

When hospitalizations, daily new cases, days-to-double and active sick (cases less recovered) numbers peak, we will have our cues the worst is over and the U.S is winning the war on Covid-19. Once the market sees that, odds are very high a new bull market may commence.

Comments are closed.