The RecessionALERT Valuation Index (RAVI) is a multifactor valuation model that examines cyclically adjusted trailing SP-500 earnings (various multi-decade horizons), the SP-500 total-return index level, total stock market capitalization, Gross Domestic Product, non-financial corporate equities and liabilities, non-financial corporate business net-worth and percentage of investors’ allocation to stocks versus cash and bonds to determine 10, 5, 3, 2 and 1 year forecasts for the SP-500 Total Return Index (dividends re-invested). The in-sample accuracy of the various forecast horizons since 1970 are shown below:

The RAVI model is updated quarterly and lags by one quarter. The data for the 4th quarter of 2014 (as at end of December) was released on 13 March 2015. Let us examine what it is telling us about ^SPXTR (SP500 Total Return Index) returns across the 2,3 and 5 year forecast horizons (we ignore the 1-year forecast due to the lower r-squared predictive ability)

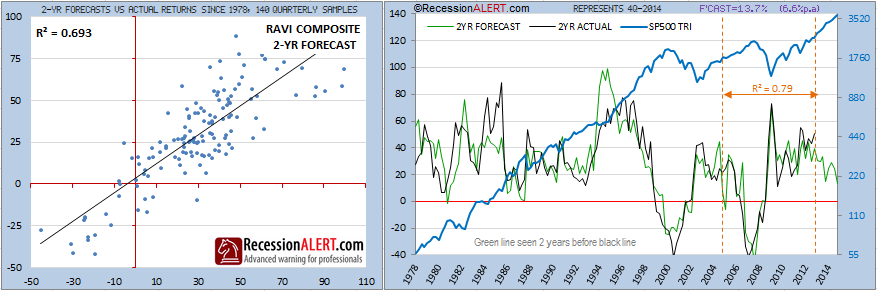

The 2-year (8 quarter) forecast appears below. The first chart on the left shows the accuracy of the RAVI model since 1978 with the x-axis representing the model forecast and the y-axis representing the actual achieved ^SPXTR 2-year returns from the forecast date. An r-squared of 0.69 might not appear much, but considering the short forecast horizon, it is actually respectable as far as forecasting models go. In fact, the r-squared correlation over the last 10 years since 2005 has actually tightened to a respectable 0.79. The model is forecasting returns of 13.7% from end December 2014 through to end December 2016 which equates to 6.6% compound growth per annum.

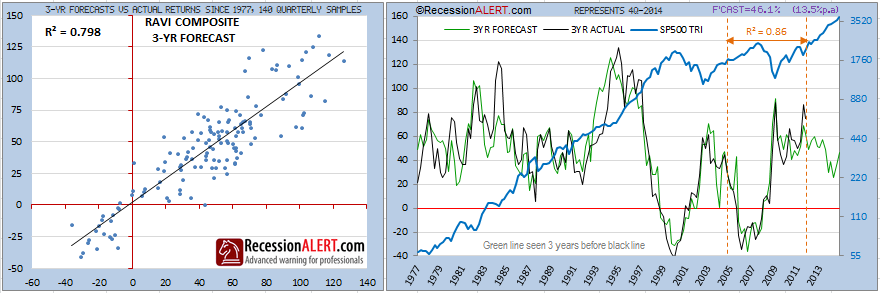

The 3-year (12 quarter) forecast appears below. The first chart on the left shows the accuracy of the RAVI model since 1977 with the x-axis representing the model forecast and the y-axis representing the actual achieved ^SPXTR 3-year returns from the forecast date. The longer horizon yields a much higher correlation as is to be expected. An r-squared of 0.79 is respectable considering the short forecast horizon, and the correlation has actually improved to 0.86 over the last 10 years since 2005. The model is forecasting returns of 46.1% from end December 2014 through to end December 2017 which equates to 13.5% compound growth per annum.

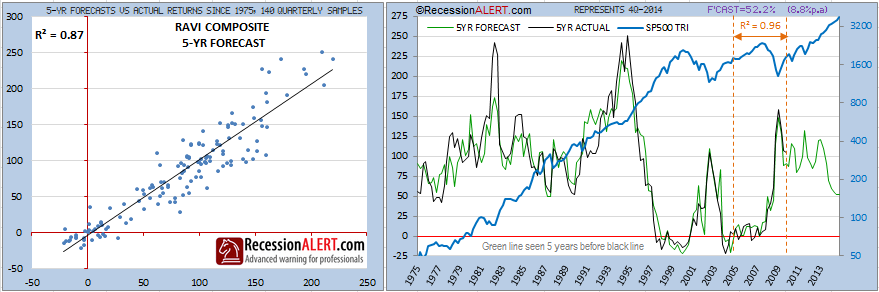

The 5-year (20 quarter) forecast appears below. The first chart on the left shows the accuracy of the RAVI model since 1975 with the x-axis representing the model forecast and the y-axis representing the actual achieved ^SPXTR 5-year returns from the forecast date. The longer horizon yields a much higher correlation as is to be expected. An r-squared of 0.88 is pretty respectable considering the short forecast horizon, and the correlation has actually improved to an astonishing 0.96 over the last 10 years since 2005. The model is forecasting returns of 52.2% from end December 2014 through to end December 2019 which equates to 8.8% compound growth per annum.

BOTTOM LINE : If we were to ignore the ^SPXTR dividend component in the annual growth estimates and apply them directly to the SP-500 Index then this implies a growth range average of (6.6% + 13.5% + 8.8%)/3 = 9.63% for the SP-500. This means the SP-500 would need to rise from 2,059 as of 31 Dec 2014 to 2,257 as of 31 Dec 2015. This is slightly higher than the 2,246 target we penned in our 3Q2014 Forecast in December.

Bear-market and Recession Indicator

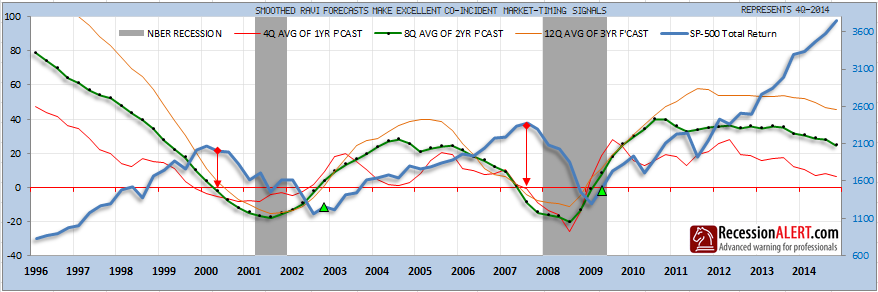

There is an interesting “by-product” of the RAVI as a bear-market and U.S recession indicator. Since the 1-year forecast “looks ahead” 4 quarters, we can average it by 4 quarters to attempt to obtain a “co-incident” view which warns of bear markets upon dipping below zero. We apply the same logic to the 8-quarter average of the 2-year forecast and the 12-quarter average of the 3-year forecast. Indeed, they all provide similar co-incident warnings of stock market corrections and 2-3 quarter warnings to recessions as displayed below. It is interesting to note that the rise of these “smoothed” indicators above zero also provide for good stock market re-entry signals:

BOTTOM LINE : “Whilst the smoothed forecasts that produce these signals have been weakening over the last few quarters and are no “pillars of strength” right now, they are not warning of any stock market corrections or recessions on the immediate horizon. In other words, the stock market is a lot less over-valued than various commentary on the Internet would lead you to think.”

It is intriguing that a valuation model can serve as stock market timing signal or recession indicator so this is certainly one new tool our clients will be monitoring closely going forward. It would be unwise to rely entirely upon this mechanism to attempt to gauge stock market risk and we recommend using it together with our existing Composite Market Health Index (CMHI) in the foreseeable future.

You should need no reminding that these are forecasts based on models utilising in-sample data and whilst our own research of the efficacy of the methodology in both robust in-sample and out-of-sample testing is highly encouraging, we should always bear in mind black-swans and geo-political events can always throw a spanner in the works and remind us that past performance is no guarantee for future returns. Also, shorter term forecasting is subject to more quarter-to-quarter variance than longer-term forecasting, despite perceived long-term correlation levels. This is especially the case when dealing with single-digit growth forecasts in above-average valuation scenarios such as we find ourselves in now when a 2-3% variance from expected outcomes actually makes a large difference. At the very least though, you can make estimates with some sound statistical reasoning behind them, since at the end of the day one always needs to be dealing with calculated risks in investing.

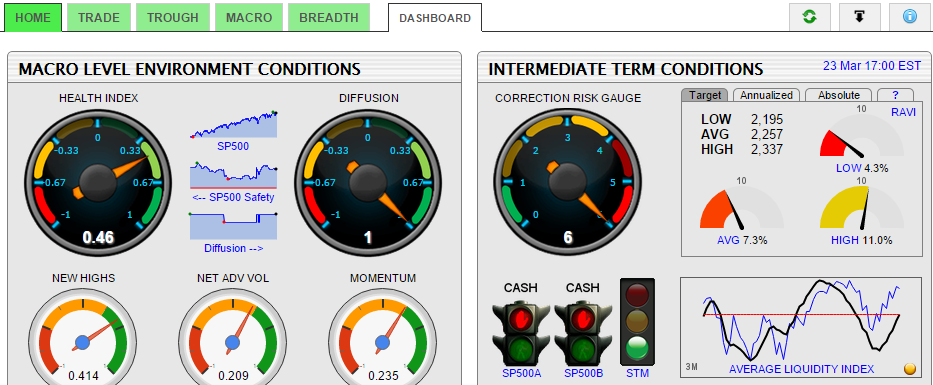

RecessionALERT subscribers can obtain quarterly updates of all the above charts in the CHARTS>MACRO>RAVI menu tab. The next quarterly update representing 1Q2015 is on 17 June 2015 and will be followed by a repeat of this analysis for subscribers. The 1,2,3 and 5-year forecasts also appear on the CHARTS>HOME>DASHBOARD tab, to the top-right of the right-hand panel as shown below, where forecasts can be viewed in real-time target (upside remaining), annualized or absolute terms (just click on the tab you desire.)

Clicking on the small tab with the “?” will display the RAVI Gauges User-Guide to assist you with interpretation of the various tabs.

Comments are closed.