NOTE : this is a very simplistic thought experiment, as determining recessions are usually much more multidimensional , nuanced affairs. Its also debatable whether deficits do indeed artificially prop up the economy or not, or even if they are bad or not. There are also potential multiplier effects with budget deficits that are not taken into account with this simple thought experiment.

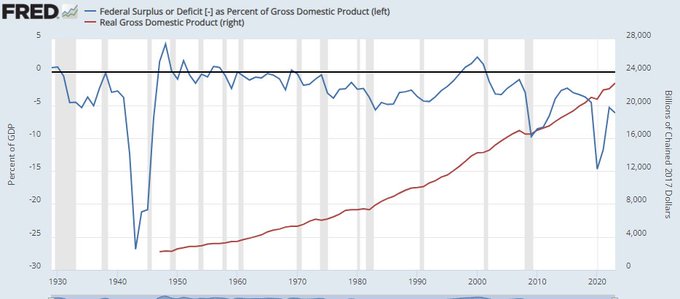

The current federal budget deficit as % of GDP is at “war-time levels” last seen in WW2

The theory going around is that this is propping up the economy artificially and repealing the business cycle. As a fun exercise to satisfy curiosity let’s try adjust for this. The chart below “removes” the actual dollar budget deficit from real GDP :

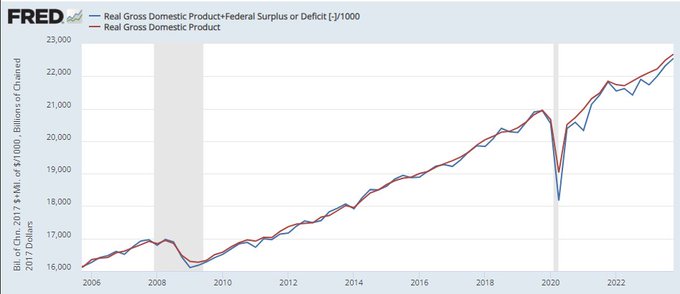

As expected, GDP would be worse off without these deficits. But would it be worse off enough to tip us into recession?

The chart below shows both real GDP (red) and the adjusted GDP (blue) on a quarter-on-quarter basis:

There are 3 additional negative GDP prints introduced on top of the 1Q2022 negative print witnessed for both GDP versions, namely 1Q2021, 3Q2022 and 1Q2023.

These are not the “2-consecutive negative quarter” syndrome that is normally associated with recession. But bear in mind a string of 3 negative quarterly prints, sequential or not – has always occurred whilst in recession.

So maybe we would be in recession without the record deficits!

NOTE : this is a very simplistic thought experiment, as determining recessions are usually much more multidimensional , nuanced affairs. Its also debatable whether deficits do indeed artificially prop up the economy or not, or even if they are bad or not. There are also potential multiplier effects on the economy with budget deficits that are not taken into account with this simple thought experiment.

Comments are closed.