Many monthly leading indices published for the U.S have about 10 indicator components, and we wanted one that had at least double this. The components of the new index are all monthly time series and are as follows:

01.Labor Market Composite (19 indicators)

02.Housing Market Composite (6 indicators)

03.Enhanced Yield Curve (EYC)

04.Money Supply Aggregate

05.Stock Market

06.Margin Debt

07.Treasury/Corporate Bond market

08.Inventories & Sales

09.Sales of heavy duty trucks

10.Manufacturing : Durable Goods

11.Manufacturing : Weekly Overtime hours

12.Manufacturing : Business Activity Changes

13.Consumer Sentiment

14.Measurement of tightening loan standards

15.Freight Shipments & Expenditures

16.EYC%-CPI% +Unemployment rate%

17. Credit Market Index (35 indicators)

18. Percentage of US states with rising unemployment

19. Percentage of US states with rising coincident indices

20.Initial and Continuing Claims

21.Lumber & Construction materials sales

22. Mortgage Backed Securities held by banks

23. C& I Delinquency rates

The far broader, more timely index offers much more comfort that nothing will be missed.

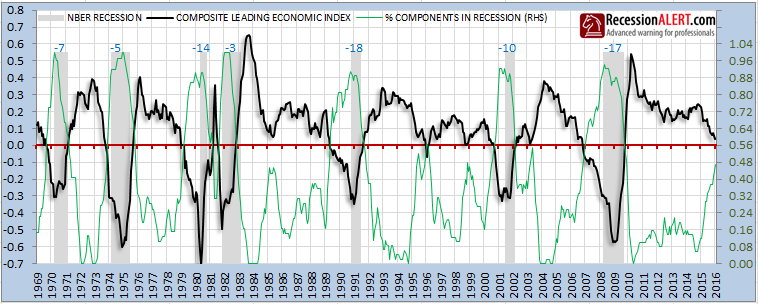

This is what the model is showing up to and including January 2016:

We have also deployed four separate recession probability model interpretations on the dataset, depicted below, and which you can read about here. Using our preferred method of taking the average of the highest two probabilities from the four has historically provided excellent recession warning with zero false positives, even with the 2020 Covid man-made recession (9 months warning) which almost every other commercial US leading indicator failed to detect in advance:

The model also creates separate Long-leading and Short-leading U.S economic indicators from the 21 components. The various lead times of the various models associated with past US recessions is depicted below:

The high number of components used, makes the USMLI one of the most comprehensive US leading indexes published today. This is our most popular monthly download among institutional clients.

A complimentary USMLEI monthly report from Dec 2022 is available below: