Reflections [Expanded version]

Understanding SP500 Gen2 Persistent Current Trend (PCT) probability model

Background

The Gen2 probability model we maintain for PRO subscribers for the SP500 provides for short, medium, long-term and macro-term probabilities of market troughs/peaks.

It does this by examining current up/down trends across the 4 time-horizons mentioned and compares them to a 30-year historical record of said trends with regards to both duration of trend and gains/losses achieved for the trends. By comparing the duration and gain/loss of the current up/down trend with the historical record, we can impute two probabilities, namely:

- The probability that the current trend will endure longer and

- The probability that the current trend will gain/lose more.

To assess an appropriate probability of a trend reversal for the current trend we find ourselves in, we merely create and average of the two above probabilities. This provides us with a likelihood assessment of a trend-reversal taking place when considering the long-term historical record of past trends with regards to both duration and gains/losses of said trends.

To categorize historical trends into short, medium, long-term and macro buckets we need an algorithm for trend classification across these multiple time-horizons. The algorithm used by the Gen2 probability model considers intraday highs and lows on the daily SP500 candles to determine true tough-to-peak gains or peak-to-trough losses of trends and works simply as follows, which is an alternate spin on the popular “Zig-Zag” technical indicator:

- If we are in a down-trend and there is a higher low within x-days ahead than yesterday’s low, then change to an up-trend.

- If we are in an up-trend and there is a lower high within x-days ahead than yesterday’s high, then change to a down-trend.

The values of x used for our model for our various trend time-horizons were determined through optimization research based on what appeared to work best in general in representing the targeted trends for the nearly three decade historical period, and are currently as follows:

- Short-term trends : 7 days (market sessions) for 211 entries for the historical database

- Medium-term trends : 17 days for 89 entries for the database

- Long-term trends : 34 sessions for 45 database entries

- Macro-term trends : 72 sessions for 24 database entries.

The charts below depict the gains/losses (intensity) and durations for the short and medium-term trends respectively as of Wednesday, 24th January 2024. We note that if we view the current trend we are on as a medium-term up-trend, it has gained 19.49% versus a 11.2% historical average, which is one standard deviation above the mean. It is not shown on the chart, but this transcribes into a 22% probability the trend will continue, or conversely, a 78% probability the trend will reverse based on the gains. We also note that if we view the current trend we are on as a medium-term up-trend, it has lasted 59 sessions versus a 35-session historical average, which is 0.7 standard deviation above the mean. It is not shown on the chart, but this transcribes into a 26% probability the trend will continue, or conversely, a 74% probability the trend will reverse based on the duration.

The useful thing with these ACTUALS charts is if a trend has continued for some time, such as the deemed medium-term trend in the lower two charts above, we can draw a horizontal orange line showing the current gains/losses or duration so we can visually see how often in the past, and when these levels we are currently witnessing have been exceeded. These visual cues sometime are easier to digest and provide more dimensions (when and how many times) when assessing likelihood of reversal than a single dimension probability percentage derived from nonlinear math equations.

Below is the same chart depicting the deemed long-term trends. These translate into probabilities of a trend reversal of 53% according to the current gains and 47% according to the current duration.

Finally, here are the deemed macro-term trends:

Introducing PCT

The selection of x in trend-determination along short, medium and long-term horizons, apart from our optimization research, is fairly arbitrary. It’s never perfect and is designed to capture intended trends for most of the time. But for a short-term up-trend using x=7 that suddenly comes to an end on a given day, what if using x=8 does NOT reverse the trend on the given day and the market pushes a new high after another 8 days? Is x=8 a better value to use than x=7? We can keep on with this argument until x gets sufficiently long enough to eliminate such choices but by then x will be too large to be useful as a “short term” trend latcher. In fact, it is perfectly reasonable that for the prior up-trend, x=7 was best in terms of timeliness but for this current up-trend, x=8 will be better for accuracy.

Let us examine a very recent example of this. On 29th December 2023 we were in an up-trend, and the high for the previous day, the 28th December, was 4,793.3. The high for the 7-day look-ahead was only 4,790.8, below the high of the 28th, so the algorithm marked 29th December as a reversal day, the first day of a new short-term down-trend. On 08 Jan 2024 the low for the 7-day look-ahead (4,714.8 on 17 Jan 2024) was higher than the low of the previous day (4,682.1 on 05 Jan), and thus we had another reversal day and a new short-term up-trend ensued:

On the surface, this looks entirely reasonable and appropriately captures a definition of short-term trends. We see that on the downtrend reversal day of 29 Dec, the probability of a short-term top on the previous day, the up-trend peak, was sitting at 91.4% an entirely appropriate warning of the impending short-term top.

Persistent Current Trend (PCT) attempts to avoid a reversal day by expanding the look-ahead value x by the minimum amount to preserve the current trend. It is a tacit admission from the algorithm that “Hey, this might not actually be a short-term reversal, and since x=7 is a generalized one-size-fits-all parameter, we can provide traders a more comprehensive review of the short-term risks by ignoring the reversal, but we’re going to have to find the smallest, larger value of x that will allow us to do this.” In this particular instance, we were fortunate to only have to increase x to 8 to maintain the current up-trend on 29th December, since the witnessed high 8 days into the future from the 29th was 4,798.5 on 11 Jan – higher than the 4,793.3 witnessed on 28th December:

So we are now giving the observer an alternate potential short-term reality – that the current short-term up-trend is ongoing. Note how for x=8, the probability of a market peak on 28th December was 89% as opposed to 91.4% witnessed with the x=7 trend algorithm. Also the PCT model is now flagging a probability of a market top on 24th January as 95% as opposed to the 41% from the x=7 trend algorithm which is now on the assessment that we are in a new, young short-term uptrend.

The chart sets we provide subscribers will include the PCT algorithm assumptions in addition to the standard assumptions, and they are available in the PCT tab in PRO>SP500 Charts . Both the probabilities of the duration and gains/losses are provided in the first two PCT charts, whilst the actual durations and gains/losses are provided in the bottom two PCT charts. Numbers in brackets represent readings for the prior day so we can assess how much the probabilities change from day-to-day:

Using the above example, we look at the top chart and take the PCT rally duration top-probability of 96% and average it with the PCT rally gains top-probability of 95% to derive a two-dimensional average market top probability of 95.5%

At this juncture the PCT algorithm is providing the investor/trader the opportunity to assess multiple potential short-term realities. Looking at the examples we provided above, in hindsight, it appears as if x=8 is indeed providing a more realistic and likely interpretation of the current short-term trend environment than x=7. We do not however use this as a reason to go and modify x to 8 permanently, since traders make heavy use of the short-term algorithm for market-timing and trend-following purposes, and we want the smallest value for x as possible that provides the most accurate generalized long-term results in order to preserve timeliness.

In this particular example shown, x only had to be increased from 7 to 8 to preserve the short-term uptrend, but you should note that on many occasions, x has to increase by quite large numbers to retain the persistent current trend assumption. In many cases x will jump into the mid to high teens to preserve a current short-term trend which means the PCT trend is no longer a viable short-term alternate reality assumption. In fact, large jumps triggered in PCT’s x-variable merely cement that the current x=7 short-term trend is most likely the actual, true short-term trend reality. At that stage, PCT is no longer suited to alternate reality assumptions on the short-term horizon but starts providing alternate realities for the medium-term trends. Thus, once PCT is in the teens it starts looking to reversals in the medium-term trends (x=17) to take its cues for finding alternate realities – this time on the medium-term timeframe.

Pre-empting the look-ahead

We provide a specialized market timing chart in the ST-ALGO tab in PRO>SP500 Charts that allows short-term trend followers and market-timers to pre-empt x=7 short-term trends without having to wait for the full 7-days look-ahead to pass. Not only is it around 70% accurate in forecasting what the full look-ahead algorithm will provide as trends, but it does it with a 2-day lag as opposed to 7-day lag. Additionally, it also allows us to assess the risks of a future short-term x=7 trend reversal together with target levels for the SP500 that are most likely to trigger said reversals.

Update on US & Global Economy

Despite all the traditional leading indicators warning of recession for some time now, the US economy seems “robust” with unemployment stubbornly making new lows.

We touched on the suspected reasons for this in our public note “The Delayed Recession” which offers the most plausible reasoning for this. However, if we dig a little deeper under the hood, the goldilocks situation may be coming to an end.

1. The Global Economy

The U.S economy is no island, with a substantial portion of earnings of stocks in the SP500 coming from abroad. It makes sense then to keep an eagle-eye on the global economy. One of our favored methods to do this, taken from our comprehensive monthly Global Economic Report, is the percentage of countries posting positive annual real-GDP growth:

From the above chart, we can conclude that it’s highly likely the global economy is currently in contraction.

Another way to look at this is to examine global economic activity as the aggregate of imports and exports (total trade volumes):

INCREDIBLE OFFER : Get 50% discount off our annual PRO Subscription, PLUS order before 15 December and get a second year completely FREE. Get your discount HERE

We observe that trade volume peaked exactly one year ago and has been on a steady decline since.

2. The Local Economy

The U.S Labor market has been the “last man standing” among the indicators used to warn of U.S recession, with national unemployment figures stubbornly low and even declining. However, unemployment has ticked up 0.5% from its lows, right on the threshold normally used to trigger a recession warning:

Despite its popularity to measure the labor market, unemployment is largely a coincidentt-to-occasionally-lagging indicator. One of the ways to overcome this is to examine the unemployment rate individually in all 50 U.S states. We have four measures to implement this and NONE of them look promising for the near future of the national unemployment rate:

The reason these unemployment “breadth” metrics work so well is that the US labor market is characterized by large concentrations of labor pools in a few economically powerful & populous states. Since every state counts as a full vote no matter how large or small in these metrics, those larger-in-number, smaller states that are more economically sensitive (or less economically robust) start throwing out early warnings when the economy becomes iffy – something that is masked by the national unemployment aggregate.

Another method to assess the state of the labor market is to focus on cyclically sensitive components of the labor market – those items that are known to have outsized reactions/sensitivity to weaker economic conditions. The traditional candidates of several manufacturing employment metrics such as weekly and overtime hours, hires and job openings together with national part-time employment, initial claims & temporary help services come to mind. As part of our comprehensive US Labor report we combine these together into a single composite as depicted below:

It is interesting to note that this leading indicator has been in contraction territory for 14 months now – identical to the warning it gave before the “Covid Recession” in 2020. Using the average lead times to US Recession and their standard deviations (albeit on a small sample) this suggests a Recession started between May and Sept 2023.

There is a meaningful correlation between the leading index and the unemployment rate. But rather than judging it by eye from the chart we have constructed a probability model that looks at the leading index and the co-movement of its sub-components, to assess the likelihood of a sustained rise in unemployment:

Interesting times indeed with all-eyes on the next set of BLS labor data…

INCREDIBLE OFFER : Get 50% discount off our annual PRO Subscription, PLUS order before 15 December and get a second year completely FREE. Get your discount HERE

The Delayed Recession

The U.S. Bureau of Labor Statistics announced a short while back that US national unemployment rate was 3.8% in August and September, versus the lows of 3.4% witnessed in both January and April 2023. On the surface, the employment situation looks healthy. Against the backdrop of virtually every leading indicator warning of recession (for quite some time now we must add), employment appears to be “the last man standing”:

The national unemployment rate in the United States is skewed by a few large, populous states with robust economies, which is why we are already in recession by the time these states roll-over and we witness national unemployment aggregates suddenly rise. One of the ways to avoid this and get a better “under the hood” view of unemployment is to inspect all 50 U.S state unemployment data. With many more less populous states with more vulnerable (or cyclically sensitive) economies now with equal weightings, we usually witness employment weakness a lot earlier in the cycle as depicted below:

The chart above shows that whilst the simple average of all the individual states’ unemployment rates continues to plumb to new lows, the percentage of US states with increasing month-on-month unemployment has risen for a fifth month in a row and now sits at 50% (some 25 states.) Whilst we only show data since 2005, this metric has been very effective since the 1970’s to get a much earlier heads-up of impending problems in the labor market and hence the economy which is 60% reliant on consumer spending.

With national unemployment averages being coincident at best, lagging at worst, another approach is to look at cyclically sensitive labor components that traditionally deteriorate up to eight months before the labor market national averages. Things that come to mind are tried-and-tested stalwarts such as manufacturing employment (hires, weekly hours & weekly overtime hours), job openings, quits, part-time employment, initial claims, permanent job losses and temporary help services.

Our Cyclical US Labor Market Composite (US-CSLMI) we publish at the beginning of each month for subscribers combines these all together and is shown below, where we can see it is clearly warning of a rise in unemployment for 13 months now – roughly the length of time of the warnings it gave in the 2020 Covid “flash” recession, the 2008 Global Financial Crises, and the 1990’s Gulf War recession.

👉We also see from the above chart that unemployment only needs to exceed 3.9% for its rise from the 3.4% lows to peek above the 0.5% red dotted line threshold which has historically always signaled the start or that we are already in recession. Something else we note from the movement of our Leading Labor Market Index is that it has a median lead-time to recession of 9 months, with a 4 month standard deviation. Given that it has already been camped “below water” in recession territory for 13 months, we can deduce a guestimate start date for recession between May 2023 and September 2023.

INCREDIBLE OFFER : Get 50% discount off our annual PRO Subscription, PLUS order before 15 December and get a second year completely FREE. Get your discount HERE

We have three methods to deduce the probability that we are about to witness a rise in unemployment exceeding 0.5% (and hence a recession).

The first method examines the long-term historical movement of the Leading Labor Index in the lead up to prior recessions and compares that to the current movement. This is called a imputed statistical probability model and appears below:

The second method examines the percentage of eight components that constitute the Leading Labor Market Index that are themselves in recession territory. This is commonly called a Diffusion and is shown below:

The third method is to merely combine the first two methods into an arithmetic average – providing an imputed (we like to call it an “assessed”) probability that is taking both the movement of the composite indicator and its underlying components into consideration:

At this time, due to every conceivable leading indicator with long-term track records warning of a U.S recession, we are making the case for a recessionary-induced bear market in US stocks. This is aptly shown in the DASHBOARD>RFD tab (see research note):

The question that requires answering, is if the 13th October 2022 lows, where the SP500 contracted 27% peak-to-trough over 195 sessions since 4 January 2022, constituted those lows. The table below, available in the DASHBOARD>NEWBULL tab, tracks the common historical signposts of recessionary-induced bear-market bottoms (troughs) in US stocks. For now, we assume the October 2022 stock market lows are a candidate for a recessionary-induced bear market trough:

We see that a small percentage (28.6%) of the traditional pre-trough signposts, which are heavily weighted to macro-economic data, occurred, whilst a much larger percentage (up to 66%) of the traditional post-trough signposts, mostly technical analysis related, occurred.

INCREDIBLE OFFER : Get 50% discount off our annual PRO Subscription, PLUS order before 15 December and get a second year completely FREE. Get your discount HERE

Explaining a delayed recession.

Below is a summary available from the bottom of the DASHBOARD>NBER PROBS tab, which examines 7 of our mainstream leading macro-economic models in relation to their historical mean lead-times to recessions, +/- one standard deviation of these means and the longest witnessed lead and their imputed target dates for U.S recession derived from how long the models have already been in recession territory. On aggregate they suggest a mean of March 2023, with a +1 standard deviation to September 2023 and a worst case Jan 2024. While these suggest a longer than expected lead-time in the appearance of the current expected recession (which has yet to be declared by NBER by the way) they are by no means a statistical anomaly.

Nonetheless, it would be fair to say that this recession is taking longer than usual to manifest in relation to that suggested by the leading economic data.

One theory that explains the absence of traditional recessionary pre-trough macroeconomic signposts, and the robustness of labor data in the face of overwhelmingly bearish leading macro data, hints at extreme excesses (or buffers) built up in the economy through:

- Massive post-Covid stimulus

- Lockdown-induced consumer spending pullbacks (or savings)

- Unprecedented near-zero interest rate environment.

Pandemic-related fiscal support resulted in a sizable increase in disposable income in the overall U.S. economy at a time when health-related economic closures and social distancing led to a significant drop in household spending. As a result, aggregate personal savings rose to $2.1 trillion – far beyond its pre-pandemic trend and much higher than in previous recessions, with Americans currently having nearly $190 billion in excess savings built-up during the pandemic still available. Despite recent large drawdowns of those funds, estimates suggest a substantial stock of excess savings remains in the aggregate economy to prop up spending and hiring to 4th quarter 2023.

As the theory goes, this massive “buffer” has to be whittled away through the current inflationary and monetary policy tightening period before being depleted enough to finally usher in a recession. It explains why this recession is taking so much longer to manifest in employment data after all the long-leading data turned bearish. Excess savings are being spent, which keeps consumer spending (60% of US economy) robust. This naturally leads to continued company profits and continued robust hiring and employment data. But once these excess savings become depleted, spending dries up, profits drop, hiring slows and employment eventually will contract.

This dynamic in excess savings associated with the pandemic period is remarkably unlike any past recessions. The chart below plots the monthly accumulation of excess savings since the onset of past recessions. Data on household assets and checking account balances support the view that households across the income distribution generally have considerably more liquid funds at their disposal compared with the pre-pandemic period:

If this theory plays out as suggested, namely excess savings depleted, then less consumer spending (60% of economy), then less corporate profits, then less hiring – then a recession has been merely delayed but is inevitable and the traditional pre-trough signposts will ultimately start to manifest as a result. This is likely to put pressure on the stock market and could potentially introduce even lower lows than the ones witnessed in October 2022.

There are several methodologies that attempt to capture the extent of Excess savings, its depletion rate and how much is left, with the latter ranging from $190Bn to $500Bn, so one cannot expect an exact science to inform us when it will be depleted or when the economy will slow as a result. All we can assume is that it explains the delayed recession and eventually it will be depleted and the repeal of the business cycle may come to an end. Until then our Cyclically Sensitive Labor Market Index is probably the most important report to watch each month.

INCREDIBLE OFFER : Get 50% discount off our annual PRO Subscription, PLUS order before 15 December and get a second year completely FREE. Get your discount HERE

Our economic research and stock market models are trusted by top Global & US Investment Firms:

Relationship between stocks & FED balance sheet

The chart below shows the size of securities held outright by the US Federal Reserve versus Wilshire Total market index as stock market proxy. We see the various quantitative easing programs that propelled the stock market higher including the massive Covid19 liquidity injection that set stocks on a never-before-seen trajectory

On the surface it appears that when the size of the FED balance sheet is flat or shrinking (tapering) stock returns are either muted/volatile or negative. Similarly when the balance sheet is expanding, stocks inflate in tandem.

Few appreciate the conventional “Don’t fight the FED” anecdote and the correlation between the size of the FED balance sheet and levels of the stock market. Putting the above two data sets into a regression analysis makes things a little clearer:

We could posit than the size of the FED balance sheet explains over 80% of the levels of the stock market.

What is interesting to note however, is that on both occasions when stocks diverged significantly from values implied by size of the FED balance sheet, stocks went into major bear markets shortly thereafter.

Stocks are still tightly correlated with the size of the FED balance sheet (right hand data points on the regression chart). It is suspected that as the FED begins to taper and stocks continue to climb, we will see another big regression divergence warning of another major market top.

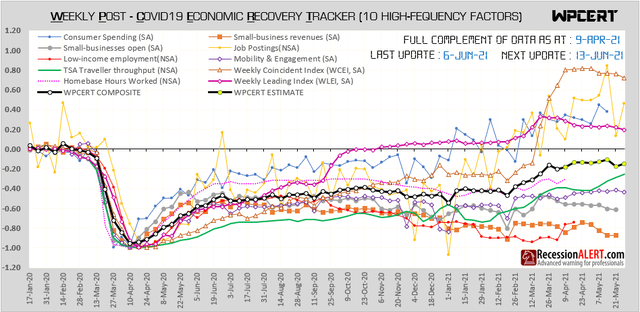

High-Frequency U.S. Economic Data Shows 3-Speed Recovery

Since the onset of Covid-19, there has been a lot of research (and release) of alternative (non traditional) high-frequency data to measure the extent of the economic collapse brought on by coronavirus lockdowns, as well as to measure the post-lockdown economic recovery.

Think of Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Apple (NASDAQ:AAPL) and SafeGraph geolocation data to track movement of people around workplaces and residential places, foot and transit traffic data, hotel occupancy, movie ticket sales (BoxOfficeMojo), TSA traveler throughput, seated diners (OpenTable) and so forth.

We have assembled a collection of such data into a Weekly Post-Covid Economic Recovery Tracker (WPCERT) consisting of the following:

- Consumer Spending = Change in average consumer credit & debit card spending, seasonally adjusted, indexed to Jan 4-31. Source = Affinity Solutions.

- Small-business revenues = Change in net business revenue for small businesses, seasonally adjusted, indexed to Jan 4-31. Source = Womply.

- Changes in small-business open (defined as having financial transaction activity), seasonally adjusted, indexed to Jan 4-31. Source = Womply.

- Job Postings = Change in unique weekly job postings, indexed to Jan 4-31. Source = Burning Glass Technologies.

- Low-income employment = Change in employment rates, indexed to Jan 4-31. Source = timecard data from Kronos, payroll data from Paychex, Earnin and Intuit.

- Mobility & Engagement = Dallas Fed Mobility and Engagement Index (NYSE:MEI). Source = Federal Reserve Bank of Dallas and geolocation data from SafeGraph

- WLEI = Weekly Leading Economic Index . Mostly financial, credit and labor market leading variables. Source = RecessionALERT.com.

- WCEI = Weekly Coincident Economic Index. 10 indicators of real economic activity, covering consumer behavior, labor market & production. Source = New York Fed.

- Traveler Throughput = TSA checkpoint Total Traveler Throughput numbers. Source = TSA

- Hours Worked = The volume of hours worked by 100,000+ local businesses and their hourly employees. Source = Homebase.

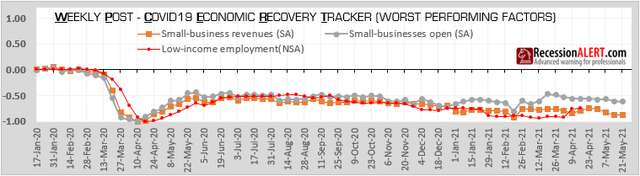

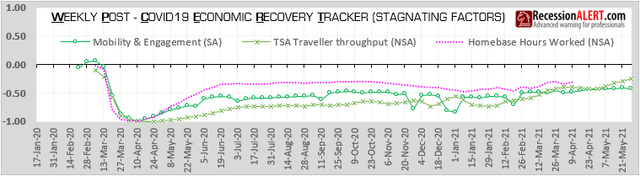

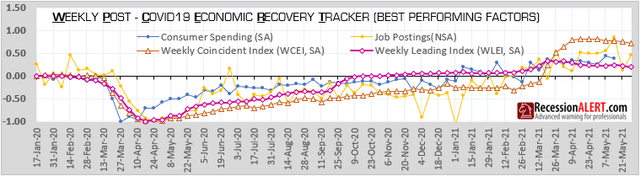

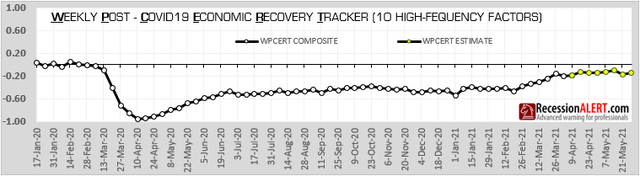

The resulting 10-factor composite is updated weekly and shown below:

We can make the following observations:

1. The composite index has completed around 80% of a recovery but progress has been agonizingly slow:

2. Small business and low-income categories have failed to adequately recover. Given the many millions of businesses and employees this covers, this is a tragedy:

3. Economic mobility, TSA traveler throughput and hours worked all managed to recover half their losses but have failed to make any meaningful improvement on top of that. It is possible that this is the result of a new remote working or work from home paradigm at play here and that these items may not reach pre-Covid highs any time soon.

4. Traditional broad-based weekly economic indicators such as the RecessionALERT Weekly Leading Economic Index (WLEI) and the New York Fed Weekly Coincident Economic Index have shown robust rebounds to new post-Covid highs. Job postings and consumer spending have also shown robust recoveries:

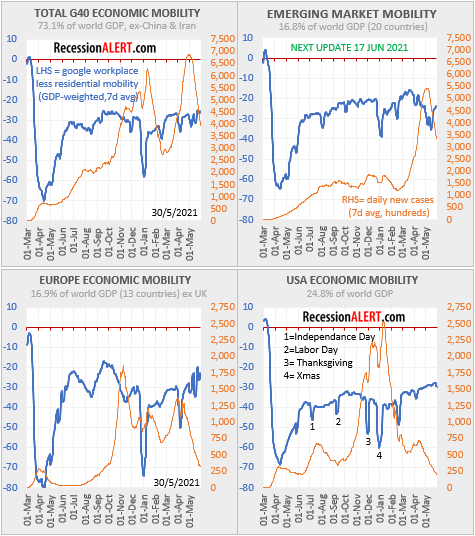

It goes without saying that a large portion of the US recovery is impacted by the success of coronavirus vaccination programs. On this score, the US seems to be faring a lot better than most developed economies with economic mobility improving whilst daily new infections are plummeting:

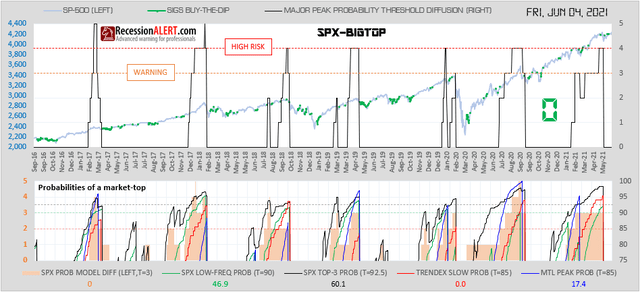

Despite the encouraging (albeit 3-speed) economic recovery, the broad stock market has likely discounted this all in already and remains stretched with major market top probabilities recently having reached levels normally associated with the start of a meaningful correction:

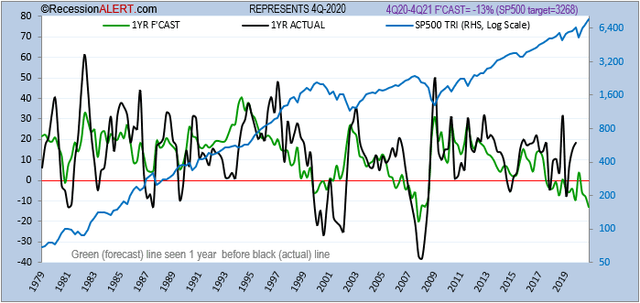

Fundamental valuations according to our RecessionALERT Valuation Index (RAVI) also remain stretched with the 1-year forecasting model (r-square of 0.45 with actual annual future returns) showing negative outcomes that at today’s price levels imply a potential 22% correction:

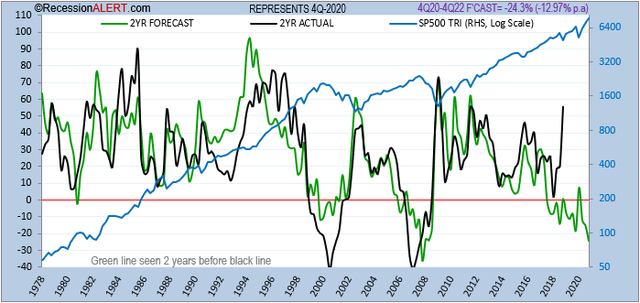

The more accurate 2-year forecasting model (r-square of 0.56 with actual 24 month future returns) also shows negative outcomes that at today’s price levels also imply a potential 22% correction ahead:

It is also worthwhile noting that the quadrennial market cycle from our STM Seasonality Model, which has been performing exceptionally well with out-of-sample dataset for the last decade is signaling a short position for the month of June:

Finally, the last shocking 4.2% CPI print for the US has led to real earnings yields plunging below 0.35% which has normally presaged a major macro level market top:

With technical metrics (probabilities of a market top), and valuations/real yields both stretched and seasonality at levels normally associated with muted forward returns, it may be prudent to investigate some measures of portfolio protection for the months ahead.

A new coronavirus wave is starting in USA

One of the most accurate and reliable leading indicators we have discovered for the U.S daily new Coronavirus infections curve is the percentage of 52 US states that have an increasing or decreasing rate of new daily infections being reported. This indicator tops out before the national US infection tally and likewise bottoms before the national US infection tally. It is thus an early warning indicator for change in direction of the daily new infections curve.

The percentage of US states with rising daily infections fell rapidly from 50 (achieved 8 days before national daily infections peaked) to almost zero as lockdowns and stay-at-home orders came into affect. It is even likely that vaccination programs contributed somewhat to the decline. However, over the last few days, this tally has jumped from 4 to an astonishing 23 states with rising daily 7-day average infection rates:

It is highly likely that the third major coronavirus wave in the US has bottomed out and we are set for the start of a new fourth wave of infections. We do not have hard data to assist with determining whether the 4th wave will be as large or larger than the 3rd, but the assumption of ongoing successful vaccination programs likely means that the 4th wave will be a lot smaller.

The chart above shows us that large jumps in the metric are normally when we emerge from lockdowns or major holidays, as depicted by the blue line which is a geolocation based economic mobility index. When economic mobility comes out of a steep dip, the black line rises rapidly as increased human interaction raises infections. As you can see we are emerging from a recent steep dip in economic mobility, created by the Presidents Day holiday that was used as a long weekend. The prior big dip where this phenomenon was witnessed was Xmas/New Year, the one before that was Thanksgiving, and the one before that was Labor Day. In each case, the national tally of daily new cases (brown line) rose dramatically afterwards.

Takeaways:

- The last big coronavirus wave has bottomed out

- Economic mobility is going to rise as we emerge from Presidents day holiday effects

- The number of states with rising daily infections will likely continue to shoot up

- The US national tally of daily new infections is going to rise dramatically, vaccinations notwithstanding.

Launch of Institutional Crypto Advisory

After hundreds of client Zoom consultations over the last 6 months, the request for a fundamentally-driven macro-risk model for cryptocurrency (specifically Bitcoin), similar to the ones we provide for the US economy and SP500, was one of the many topics topics among just under 49% of the calls. The request was highest among high net-worth private investors, family offices and small funds, but we expect company treasurers and larger institutions to become more formally involved with Bitcoin as a possible hedge against dollar depreciation and inflation.

Fortunately we have over five years active experience with Bitcoin and Ethereum, having been involved when BTC was still $900 in late 2016. What was a small 1% exposure built up over late 2016 to early 2017, has ballooned to over 10% during this time, meaning we have a very active interest in monitoring macro-cycles and risk models associated with the cryptocurrency. Whilst we were surprised at how many of our clients have, or are planning exposure to Bitcoin (either in their private or formal capacity) we are delighted to share with them the fruits of our five year journey.

The Crypto Advisory has been designed for large investors, family offices, company treasurers and fund managers who are exposed to Bitcoin (either through direct ownership or Trusts such as Grayscale) and seek institutional-grade macro-level, fundamentally-driven risk and valuation models. The charts and models displayed here are what we have developed over the last 5 years for our own crypto investments and currently deem to be the most important items to track and measure macro risk/opportunity for cryptocurrency.

The models are a mixture of supply/demand metrics, valuation, regression and pricing models, as well as cyclical factors. All data used are a mix of on-chain analytics (data taken directly from the blockchains themselves), futures markets and exchange pricing data.

The Crypto Advisory is provided as standard with our most basic subscription and thus also includes unlimited in-person consultancy (via Zoom) with our crypto analysts to allow any private investors, family offices or institutional clients to jump start their crypto operations or to sanity check their existing ones. Expertise can be provided regarding what wallets and exchanges to use, which crypto-assets to focus on as well as what additional tools may prove useful.

Stage is set for stock market gains in November

The SP500 has put in a 7.4% peak-to-trough correction since 12 October.

In the last 20 years, according to our SP500 probability model, corrections of more than this magnitude have occurred only 11.4% of the time, hinting at a 88.6% probability the worst is over.

The SP500 has also put in lower weekly closes 3 weeks in a row. Additional lower weekly closes have only occurred 15.9% of the time in the past, implying a 84.1% probability the worst is over.

The VIX has jumped to levels only exceeded 8.4% of the time, implying a 91.6% probability the worst is over.

The correction has endured 15 sessions, with longer corrections witnessed only 17% of the time, implying a 83% probability the worst is over.

These 4 measurements imply we are close to having seeing the worst, according to the historical record of price action.

Further conviction for a positive month in November comes from the Seasonality Timing Model (STM) where the Composite Seasonality Score (which examines long-term historical record of monthly gains, positivity rates and gain/loss ratios across 4 different seasonality cycles) is 74.0, just under the extremely bullish threshold that encourages leverage due to high incidence of positive outcomes:

Given the large correction we saw over the last 2 months, this prediction is much more likely to come into play. It is not often we see 2x LEVERAGE levels on the seasonal forecasting models coupled with a prior 2 month or longer correction of 7% or more. In 90% of the cases the seasonal forecasts prove accurate.

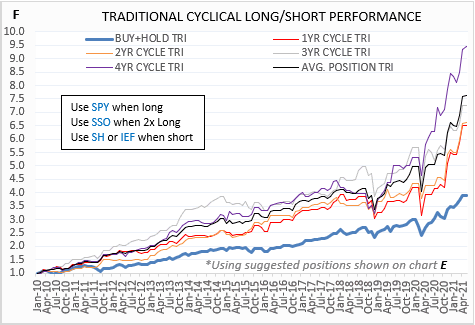

Even if we were concerned about the effects of the current election on outcomes, we can examine the 4-year Presidential Cycle model for cues on this particular Novembers’ performance. This model has been out-performing the 1,2 and 3-year cycles over the last decade:

The Presidential Cycle model is bullish for November (1 long position), and even suggests to lever-up in December (2 long positions due the historical 80% win rate for that month):

On the whole, across the 1,2,3 and 4-year seasonal cycles, as well as the composite model, the upcoming 3 months of November, December and January are forecast to be statistically bullish.

The easiest way to cue your market entries, if you are following any (or all) of our 12 market timing models, is to simply examine the SIGS signal composite for the first two or three BUY signals to appear. The bottom signal composite line will jump from -12 (all bearish) to a higher reading as the first models start going bullish:

The SIGS composite is available from the “SP500 Signals” tab in the Charts Dashboard.

You can also go and examine further detail for the next 3 months in the Seasonality Timing Model in the “STM” tab in the Monthly Charts menu.

A new, bigger U.S Coronavirus peak now likely

For a while, it seemed we had tamed the coronavirus epidemic in the US. But new daily cases are on the 3rd surge since the epidemic hit US shores:

The U.S lags most of Europe’s ‘ countries by about 4-6 weeks on the coronavirus curve. When we saw the infections picking up in Europe after lockdowns had been eased, we wondered if the US might be able to dodge a bullet, but sadly it appears a new wave of infections is now upon America as we follow the same path as those countries in Europe that were ahead of the US curve:

Particularly alarming is Italy – you will remember the horror stories coming out of Italy in the lead up to its peak, and it looks like they are set to shoot past that peak. The United Kingdom has simply blown past the old peak as has Spain.

Given that many developed countries (that had massive waves of infections they managed to suppress) are now surging past their prior peaks, it is wishful thinking to assume the U.S will not follow suit.

The reasoning for this is simple – deep suppression of daily caseloads, leads to relaxation of stay-at-home orders and lockdowns, which leads to increased mobility and social contact, and gradually a slippage in population diligence, caution and due care. Given that not one country is even close to herd immunity, the outcomes are predictable.

The below charts show that among the 40 largest economies in the world, economic mobility as an aggregate has stalled for some time now and almost 40% more countries have rising daily infections than those with falling infections:

To this end we need to prepare to exceed the U.S daily new cases peak of 67,000 and prepare for this to move close to 100,000 new cases per day.

Without a doubt that is going to lead to more stay-at-home orders and lockdowns, even if not as harsh as the initial ones, and it is going to have a huge hit on U.S Economic mobility, which as we have shown, is running comfortably north of 0.9 r-squared to other weekly leading economic indices and is an excellent proxy for measurement of economic conditions.

In a nutshell, we have not seen the worst of the Coronavirus epidemic in the U.S and the “main peak” is yet to come, with the economy likely taking a hit.

The U.S economic rebound has already stalled according to a broad measurement of high frequency data:

The resurgence in daily new coronavirus cases is not isolated to a few states. We have the number of states in serious trouble (within 20% of their daily peaks) climbing from about 10 to almost 30 now. The number of states that had managed to bring the virus under control (less than 33% of their daily peaks) has dropped from 12 to just 7 now.

The next U.S president is going to find themselves in uncharted waters shortly after being inaugurated and its difficult to see how economic mobility, and thus the economy, can break out of its current recovery plateau. In the prior (2nd) infection surge, economic mobility flatlined, so we should expect nothing less. In fact, it is not improbable that the recovery pulls back somewhat against a backdrop of a 3rd surge.

The road to immunity, herd or vaccine, is likely to be a rocky ride well into 2021.

Coronavirus Recession likely ended in June

In this exercise, we examine the current behavior of various of our US leading economic indexes to past history to determine a likely recession exit date.

The charts we display below are automatically displayed (depending on your selections) in the monthly data file Analysis Tool that is published for PRO subscribers, and can be found in the new RECOVERY sheet in the Excel workbook.

We start with our oldest and most widely followed index, the Weekly Leading SuperIndex:

Let us examine the behavior of this index around the prior 7 recessions and then align the current 2020 vintage trough (lowest point) with the trough of the average of the prior 7 vintages to determine the most likely month we exited from recession:

We see from the above chart (taken straight from the one produced in the RECOVERY tab) that the average of the prior 7 SuperIndex vintages troughed 3 months before the first month of the new expansion. The red line in the current SuperIndex vintage (last point representing September 2020) is aligned to this trough. This implies September 2020 represented the 2nd month of the new expansion, meaning the recession likely ended in July 2020.

NOTE : It is important to understand that the current vintage represented by the red line, is time-shifted so that its trough aligns with that of the average of the prior 7 vintages. This means its timing relationship with the current recession and prior vintages is meaningful to the right-hand-side of the trough only, and you cannot use data to the left of the trough to compare the current vintage to prior ones.

Let us repeat the exercise with our 2nd most popular leading economic index, the high-frequency US Weekly Leading Economic Index (WLEI):

In this case using prior vintages and 2020 trough alignment to average of prior vintages, we see that the suggested last month for the recession was a month earlier, namely June 2020:

We repeat the exercise again for our third most widely followed index, the 21-factor US Monthly Leading Economic Index (USMLEI):

In this case using prior vintages and 2020 trough alignment to average of prior vintages, we see that the suggested last month for the recession was June 2020:

We can use the monthly data file to select any number of our 15 models, to create a composite and repeat the above exercise. For example, our Recession Forecasting Ensemble (RFE-6) consists of six different models taken from the SuperIndex report . The RFE is very widely followed by SuperIndex readers, since it has a zero false positive real-time history when using more than one model in recession as a overall recession trigger, when examined as a ensemble (a count of number of models flagging recession):

The RFE-6 is arguably our best performing model when one considers its zero false positive rate, ideal “golden” lead-time of 1.5-2 quarters (See Recession: Just how much warning is useful anyway?) and lowest coefficient of variance (high consistency of lead times):

Let’s look at the RFE-6 as a single equally-weighted average of standardized components composite as opposed to an ensemble/diffusion:

In this case using prior pre-recession vintages and 2020 trough alignment to average of prior vintages, we see that the suggested last month of recession is May 2020:

Let us finally mash up all 15 of our models together into a single super-duper composite which we call RFE-15, which encompasses 4 coincident models, 3 short-leading models, 5 medium-leading models and 3 long leading models. Here is the ensemble (or diffusion of models in recession) with optimum trigger of 3 producing the lowest coefficient of variance (CoV)

Here is the equally weighted, standardized components composite (as opposed to viewing them as an ensemble):

In this case using prior pre-recession vintages and 2020 trough alignment to average of prior vintages, we see that the suggested last month of recession is again July 2020:

In summary, we have estimates ranging from May 2020 to July 2020 for the end of the current recession, with June 2020 the most likely candidate.

The real issue for us moving forward is not if we have emerged from recession or not, but if the recovery can maintain a steep slope and for how long the recovery can continue without faltering. All signs (here, here and here) point to a softening again of the economy in Q4-2020 and discussions of a double-dip recession may well resurface as a result.

Summary of Service Additions & Improvements

We wish to highlight the following recent additions and improvements since April 2019, to our subscriber deliverables, as well as highlight some older features you may not be aware of.

1.Alerts archive

Many subscribers do not know that you can access a multi-year chronological archive of end-of-day alerts from the REPORTS>ALERTS tab.

2. Stock Market reports

The RecessionALERT Valuation Index (RAVI) quarterly report is published in the STOCK MARKET tab, where the Monthly Composite Market Health Index (CMHI) report is also published:

3. Weekly charts

A new menu page has been created to group weekly updated charts together.

The WEEKLY LEADING INDEX is our highly popular Weekly Leading Economic Index (WLEI) compared with our most popular index, the Weekly SuperIndex and the ECRI WLI for comparison. PRO subscribers can also download the historical data in Excel and view a chart of all six the WLEI components from here:

The NBER PROBS chart shows the probabilities of US recession depicted by all 10 of our recession models:

The WCMHI is merely a weekly chart of the Composite Market Health Index:

The Central Bank monitor tracks policy rate decisions from 90 central banks around the world:

The US Yield curve diffusion is widely followed among our institutional clients:

The STIMULUS chart tracks liquidity injected by the Federal Reserve into the US banking system:

The GLOBAL MOBILITY chart tracks the GDP-weighted economic mobility of the 24 largest economies in the world, to assess the global recovery

4. Monthly Charts

There is a new menu page that groups all monthly updated charts together.

The GOOGLE chart shows our proprietary multi-factor Google Trends recession monitor:

The GE ACTIVITY tab shows the Global Economic Activity index taken from our comprehensive monthly Global Economic Report:

The U52 chart is derived from our Monthly Labor Market Report and shows unemployment rates in all 50 US states from various angles that have proven to be effective in warning of recession:

The YELLEN chart, also taken from our monthly Labor Market Report, shows the famous “Yellen Labor Indicator”

The WORLD LEI-1 tab shows our Global Economic Leading Index together with its preferred leading growth metric, the number of countries with rising LEI’s. This is taken from the comprehensive Global Economic Report:

WORLD LEI-2: just shows the 22-factor RecessionALERT Monthly Leading Index (USMLEI) together with the World LEI growth metric. This is very useful as the Global LEI growth metric actually leads the US Monthly Leading Index:

WORLD LEI-3 shows growth of the NYSE together with the Global LEI growth metric as the growth metric also leads the NYSE by 6 months with a not-insignificant long term correlation:

The VIX/YC chart updates a chart produced from one of our most popular 2019 research notes : “Impact of monetary policy & Yield Curve on future volatility” This research note was rather prescient in that it was penned a few days before the VIX exploded upwards, and we continue to track the phenomenon to completion in this chart:

USMLEI PROBS tracks the 4 main probability models derived from the monthly published US Monthly Leading Economic Index (USMLEI). The models are discussed in this research note and provided 7 months warning to the current recession:

MCMHI is merely a monthly chart of the Composite Market Health Index (CMHI).

STM are all the detailed charts from our Seasonality Model, the performance of which is shown below. We see that the 4-year cyclical model is performing very well, but our proprietary Composite Seasonality Model is performing even better (red line in bottom chart)

5. Projects Workbench Menu

When spending many months researching and building new models we often reach a point where the model is “nearly good enough” or in “Beta” and we run it out of sample for a few months to see that things are working as they should, or to experience the model live first hand to work out if any improvements are required. Rather than have these models hidden in our laboratory, we post them here so that clients can share the final testing and refining process with us. Once models have undergone this “live testing”, improvements and client feedback, we normally then embark on the full documentation before making it available as a production model. As these are Beta models, you are advised extreme caution in using them. Note that the models could change at any time as we make refinements during this process.

Most notable here are our new daily updated 4-factor Medium Term Liquidity Index:

…and our 7-factor weekly updated WPCERT which you can read about here:

6. COVID-19 & Economic tracking enhancements

The USA MOBILITY-1 tab tracks economic mobility and daily infection rates in the 16 largest states in the US, contributing some 70% to US economic output (8 largest shown below):

The USA MOBILITY-2 tab tracks the same states using this innovative alternate methodology that uses total infections on the x-axis (instead of date) and also shows Rt (reproductive rate) figures:

STATE BREADTH tracks US state daily infections and mobility as well as breadth metrics of these (number of states with increasing daily infections and number of states with decreasing economic mobility):

G24 MOBILITY tracks economic mobility and daily infection rates in the 24 largest economies in the world, contributing over 67% to global economic output (8 largest shown below):

G24 COMPOSITE tracks the 24 largest economies as a single global GDP-weighted economic mobility composite together with daily infections and some interesting breadth metrics, to allow us to gauge how the overall world economy is shaping up:

7. QQQ Probability Model

PRO subscribers now also have access to detailed, daily updated market trough and market peak probability models for the highly popular Nasdaq-100. The methodology used to compute these probabilities is the same as the one used for SP500, VTI, EFA, EEM, IJH and AGG – described in this research note:

8. Dashboard

There is now a DASHBOARD menu that summarizes many poplar market timing and macroeconomic models in our stable. The SP500 SIGNALS tab tracks the current status of our market timing models. It also provides direct links to the detailed charts (as pop-up images) we maintain on each of the models:

RAVI FORECASTS shows how much headroom we have to various SP500 future targets based on the forecasts made by the RecessionALERT Valuation Index (RAVI)

The next two tabs track many of our models via easy-to-use gauges. You can view the details about these gauges here, but we do a brief summary below.

PROB MODELS & LIQUIDITY on the top-row shows the state of the peak/trough probability models for the various ETF’s together with direct pop-up links (B=Bottom, T=Trough and C=Combo Chart) to the various charts if your subscription level allows it:

On the bottom row it shows the status of 6 of our most popular liquidity indexes together with direct pop-up links to their various charts.

MACRO ECONOMIC MODELS shows the status of our main US economic & recession prediction models:

Direct pop-up links to charts for each of the above models will be provided shortly.

US Economic Recovery update

NOTE : All the charts displayed below are updated daily/weekly and available for subscribers from the various chart menus.

Since the peak daily infection rate of over 75,000 achieved on 17 July 2020, daily infections fell consistently to a trough of just over 20,000 on 8 September 2020. During this period, US national economic mobility (Google workplace less residential mobility indices) climbed slowly as the economy attempted to get back to work. Since just after Labor Day however, the daily infection rate has picked up steadily to just under 50,000 across a broad swathe of US states, with over 40 states reporting increasing infection rates from a low of just 14 at the trough. Some 17 of these states are in serious trouble, as highlighted in red below:

Whilst the US’s large population size has resulted in her reporting the most infections and deaths among all countries, the actual death rate per capita is smack bang in the middle of the top-twenty countries by mortality (with populations more than 10-million) as depicted below:

Taking a peek under the hood at the eight largest US states by economic contribution, with over 51% of US national output, reveals that all but Illinois, Pennsylvania and Ohio have got their daily infection rates nicely under control and all states in this group seem to have increasing economic mobility:

The states ranked nine through sixteen by economic output, contributing some 18.4% of total national GDP, show that North Carolina, Virginia, Michigan and Maryland are struggling to convincingly bring down daily new infection rates:

Again, all states seem to be improving their economic mobility, some better than others. The difference however appears to be among how this is expensed against increased infection rates.

We can roll-up all the statewide data into a national US view, and compare among the eight largest economies in the world (excluding China whose numbers are highly suspect and for which no mobility data is available anyway), contributing some 49% to total world economic output:

Again, most countries are experiencing improved economic mobility, but with huge variances in costs in terms of infection rates. India is clearly the worst off with stagnating economic mobility and exponential increase in daily infections to just under 1-million der day! France and United Kingdom seem to be well into their second waves, with Germany and to a lesser extent Italy potential problem areas developing.

Here are the world economies ranked nine through seventeen, contributing some 12.8% to global economic output:

Spain and the Netherlands are clearly in the grips of ugly 2nd waves of infection which have exceeded prior peaks, whilst Canada is in the early stages of a second wave, yet to exceed her prior peak. Indonesia is still in her first wave with the daily infections looking suspiciously like a exponential curve candidate. South Korea nipped her second wave in the bud whilst Australia has all but defeated her second wave. Russia appears on the cusp of a second wave whilst Mexico appears to be fighting to get her first wave under control.

Here are the world economies ranked seventeen through twenty-four, contributing some 5.7% to global economic output, where pain seems to be isolated to Poland, Belgium and Switzerland. Taiwan and Thailand seem to have infections tightly under control and their economic mobility is almost at pre-covid levels as a result:

We can now finally roll up the data for all 24 of the worlds’ largest economies, contributing over two-thirds of global economic output. Note that we produce a GDP-weighted economic mobility index in this exercise, to match current global economic conditions the closest:

Following a June to early August “economic flatline” it appears that the global economy is picking up her skirts to run again, posting decent gains since mid-August, and posting new all time highs above -30% from pre-covid levels. It is interesting to note that the G24 group excluding US appears to have a slightly more improved economic mobility curve than the US, but that this is coming at the expense of daily infections, since US daily infections are decreasing from the 2nd wave whilst the other 23 countries, as an aggregate, have their infections still increasing in what appears to be the first initial wave.

Whilst there is always room for improvement when it comes to lives lost, it appears the US may not be faring as bad as some of the media is making out. There are certainly a lot of populous countries and even some developed ones that are faring worse. There are a lot of things moving in the right direction with the US pandemic response, and as depicted below there is still some room for improvement on a few metrics:

We can look beyond just mobility metrics and geolocation data when tracking the current US economic recovery. Here is a U.S 7-factor high-frequency economic recovery tracker we maintain for clients:

What has been interesting to observe is the surprisingly high (for us at least) correlation of 0.75 to 0.94 (aggregate 0.92) between these “alternative high frequency measurements” and the more traditional RecessionALERT Weekly Leading Index (WLEI). Using all seven of these high-frequency factors together as opposed to just looking at economic mobility, shows a slightly more pessimistic assessment of the US economic recovery. The WPCERT composite is still below the peak registered on 26 June and some of the prints of the earlier available components hint at a slight decrease in the WPCERT composite in the ensuing two weeks.

It is safe to say we are likely to see a surge in daily infections in the US and some corresponding weakness in the economy in the coming few weeks. This lack of forward visible momentum is likely to present some tailwinds to the local stock markets and perhaps extend the duration of the current correction.

Our multi-factor trough probability model for the SP500 is showing that the current drawdown has only been exceeded 9.3% of the time in the last 20 years(implying a 90.7% probability of the worst being over), whilst the current duration has been exceeded 19.7% of the time (implying a probability of 80.3% of the worst being over.) The VIX has room to expand (having exceeded current levels more than 56% of the time) and we have some room for more support failures to shake investor confidence, with a probability of only 69%. However, we have seen 3 down-weeks in a row which has only been exceeded less than 10% of the time in the last 2 decades. The Demark Buy-setup count model is indicating a probability of only 79.9% of a bottom. All-in-all the average probability of a bottom from all six factors we track is just over 75:

Experience has shown that it is more prudent to assess the average of the top-3 highest probabilities from the six presented, together with a diffusion of the number of six models above 90% probability, when assessing buy-the-dip trading opportunity. These are both shown in the bottom pane. The current correction is approaching interesting levels but is not quite there yet.

NOTE : All the charts displayed above are updated daily/weekly and available for subscribers from the various chart menus.

Global Business Mobility remains in decline

Global Business Mobility, defined as GDP-weighted Google geolocation data of workplace less residential mobility for the 24 largest economies in the world, representing over two-thirds of global GDP, remains in decline despite a recent uptick:

When excluding USA from the data, the situation appears even worse, as depicted by the second chart above showing steeper decline of business mobility as well as a daily Covid19 infection rate that appears on the rise. This is due to the fact that the US business mobility is essentially flat-lined versus the other 23 economies that are mostly in mobility decline and the US has had a sharp decline in daily reported new Covid19 infections.

In fact all but two of the 10 performance metrics we track for the management of the US coronavirus outbreak are showing positive outcomes and we expect US business mobility to start its second-leg upwards shortly, especially as summer vacation comes to an end:

Additionally, the number of US states with decreasing mobility has declined to less than 5 and the number of US states with increasing daily infections has come down nicely from 45 to around 21 currently. This implies a broad-based improvement of the above 10 metrics:

Business related mobility remains an important aspect of tracking the Covid19 Recession recovery. Various mobility indices we monitor are actually showing a very high correlation to our Weekly Leading Economic Index (WLEI) which tracks mostly financial and labor market data:

You can see the full set of individual US State and country-level mobility/infection charts for the 23 largest economies in the world at the COVID-19 Menu in the US MOBILITY tab. The data has just been updated as part of the usual Thursday mobility charts update.

Global V-shaped recovery stopped in its tracks

The US State and G8 Mobility Charts have just been updated in the Covid menu.

The U.S has seen a whopping increase in infections across a broad swathe of states since emerging from lockdown :

As a result, US and state economic mobility has taken a huge hit. Although the US is only about 49% of the G8 GDP, there are enough G8 members also taking strain to stall the entire G8 group recovery. Since the G8 represent almost 49% of the world GDP we can assume the global V-shaped recovery has been stopped in its tracks:

There is a new menu item in the USA MOBILITY tab that allows you to view the G8 GDP-weighted composite as well as mobility of all G8 members together on one comparative chart. Just click on “See G8 Composite” as indicated below:

WHY IS ECONOMIC MOBILITY SO IMPORTANT?

There has been a lot of interesting research into the efficacy of high frequency geolocated mobility indices to represent economic reality. More specifically the new Dallas Fed Mobility and Engagement Index (MEI). Without much doubt, diminished mobility and engagement was a major factor in the slowdown in economic activity and the sharp rise in unemployment. The MEI bears this out with a high correlation to the Dallas Fed Weekly Coincident Economic Index.

Our Economic Mobility Index (EMI) which is workplace less residential Google mobility indices, and which we use in all our mobility charts, has a 0.924 r-square to our Weekly Leading Economic Index (WLEI):

The RecessionALERT EMI has a remarkable correlation (r-square=0.974) to the Dallas Fed MEI, considering how much simpler and less complex the construction of the EMI is:

We can therefore conclude that high frequency geolocation-derived mobility data is a good proxy for leading weekly economic conditions, given the severity with which mobility has been curtailed during the pandemic. Once we are back to “normal” less pandemic conditions (when mobility is back to pre-lockdown trend), there may not be enough movement in the mobility data to render them as useful anymore however.

This correlation is particularly useful to construct an index of global leading weekly economic conditions (as we have with the G8 composite) to track the global recovery, since there are not many (almost none) high-frequency leading indicators available for representing economic conditions on a global,continent or economic grouping (G8, G20, BRICS etc.) basis.

At this stage we might have to discard the V-shape recovery hypothesis and perhaps look to a Nike swoosh or W-shaped recovery for both the US and the rest of the world.

Headwinds increasing for the stock market

NOTE : All images and charts displayed below are regularly updated and available to subscribers from the CHARTS menu.

The SP-500 has enjoyed an incredible 40% rally since the 23 March lows. This was mostly fueled by an unprecedented FED stimulus program, which is now coming to an end within the next few weeks:

Unless more stimulus is unleashed (and a further $1.5-$2 trillion seems likely) the risks of a stock market selloff are high, especially given that the market is some 12.7 to 22% overvalued according to our RAVI US Valuation model (Also see our bear market warning to clients in June 2019):

The unlocking of the US economy has now led to a 2nd wave of infections and the US economic mobility index (an excellent high frequency proxy as an economic indicator) is rolling over and falling back to 45% of the pre-recession level:

The stock market will not take kindly to this if the rollover persists, and there is every likelihood it will persist, since (1) the economic mobility rollover is broad and covers most US states that matter to the economy (log in to see the next 8 largest economic contributors):

…and (2) the Covid-19 infection spikes are also occurring in most US states, meaning mobility will remain under pressure for a while:

The traditional high-frequency macro-economic data (WLEI2) has been rolling over in the last 2 weeks in sympathy of the economic mobility data:

Interestingly, ECRI’s WLI keeps increasing and is no doubt contaminated with out-sized improvements from weekly claims coming off unprecedented lows which is masking the other components in their series. Since our WLEI2 limits component movement contributions to within 2 historic standard deviations for this exact reason, it does not succumb to this issue.

From a seasonality perspective, the month of July is not very bullish with a score of only 23.8 out of 100 according to our Seasonality Model:

If there is indeed a correction in July, then this will set-up August for a high confidence bullish seasonal month especially for the Presidential (4-year) cycle which suggests a rare 2x leverage month in August. We mention this since the 4-year presidential cycle has outperformed all the other cycles over the last decade:

The risk/rewards are therefore skewed toward the bearish side in the near term and a 5-10% correction is probable unless the conditions we mentioned above change materially. On the positive side we fully expect any dip to be bought hard as undoubtedly the FED will issue another round of stimulus and nobody has ever gone broke by buying the dip on the back of the start of any new stimulus.

Do not expect any pleasant low volatility long-term rallies though. Literally 3 days after we issued a future increased volatility trend warning on the Long-term Volatility Prediction Model chart update on 17 Jan 2020, the VIX average has been rocketing upwards which is likely to persists to roughly early 2022 (with VIX peaking roughly 12 months earlier around early 2021):

US enters 2nd wave of Covid19 infections

Note : Most charts shown below are available to subscribers in the COVID19 analytics section.

Summary

- Economic mobility in US increasing at a slower pace than Covid-19 infections, contrary to rest of G7.

- At a state level, New York, New Jersey, Massachusetts & Michigan are leading economic mobility recovery vs infections.

- US has moved from a peaked scenario to join a host of second-wave countries struggling to contain infections after lockdowns.

- Stock market is going to struggle to post new highs until daily infections decrease again or FED resumes stimulus.

US versus rest of G8

Instead of using traditional economic indicators (most of which have a month or more delay) we can examine high frequency (weekly) data from the Google community mobility indices to try and figure out how economies are recovering. These indices use Android smartphones and Google maps requests to anonymously track movement trends over time by geography, across different categories of places such as retail and recreation, groceries and pharmacies, parks, transit stations, workplaces, and residential.

During lockdown, residential movement typically goes up and workplace movement trends down. To adequately track traditional economic activity, we can subtract residential movement from workplace movement to derive an Economic Mobility Index and represent this as a % of the pre-lockdown trend.

Instead of plotting the Economic Mobility Indices versus time, we can plot them versus cumulative infections to achieve a two dimensional view to gauge mobility improvement versus infections, as we have done below in charts comparing the US to the G8 developed economies which represent over 50% of global economic output.

The charts have been designed so that we can use the 45-degree angle line as a guide for how well we are doing. If the mobility curves are trending above 45-degrees, mobility is improving at a faster pace than infections, which is a desirable outcome. If the curves are trending below 45-degree angles then infections are outpacing mobility improvements which is a less desirable outcome.

We can see from the above chart that the US mobility curve is at a 19.4 degree angle which means we are not getting bang for our buck with the lifting of restrictions, as infections are outpacing mobility improvements. The UK at 43.1 degrees is faring much better, with infections marginally outpacing mobility improvements whilst Canada at 46.7 degrees angle has mobility marginally outpacing infections.

France, Italy and Germany are doing very well with angles in excess of 73 degrees. They are getting great bang for their buck by relaxing restrictions and there appears to be no post-lockdown “2nd waves” of infections.

US States

Whilst the national US figures are interesting, we can see that outcomes on a state-wide level vary significantly:

Some explanations on the charts above will prove useful. These weekly charts of the 12 main US statewide epicenters contributing 70% of total US infections and 60% of total US GDP are designed to measure the pace of economic re-opening and recovery as well as provide early warning of a potential 2nd wave of infections that could derail the recovery in question and send the stock market into another tailspin.

- The LEFT vertical y-axis = 7-day average of workplace less residential Google mobility indices as % relative to pre-lockdown baseline.

- The RIGHT vertical y-axis = Rt reproductive rate – the average number of people who become infected by an infectious person. If Rt is < 1.0, virus will stop spreading.

- The horizontal x-axis = cumulative Covid-19 reported infections (in thousands, measured daily).

FOR THE BLUE Mobility curve:

- Flatter slopes < 45-degrees are less desirable outcomes and indicative of slow mobility recovery and/or increasing infection rates (infections rise faster than mobility)

- Steeper slopes > 45-degree angles are better outcomes characterized by rapid mobility recovery and/or decreasing infection rates (mobility rising faster than infections)

FOR THE ORANGE Rt curve:

- Flatter slopes less than 1 are more desirable outcomes and indicative of lower growth in disease infectiousness (less likely 2nd wave of infections)

- Steeper slopes more than 1 are worse outcomes indicative of higher growth in disease infectiousness (more likely 2nd wave of infections)

- Rt Slopes < Mobility slopes are highly desirable, meaning mobility is increasing faster than infectiousness.

ABOUT THE SLOPES:

- Slopes for mobility & Rt curves are represented as angles in degrees, with horizontal being 0-degrees and vertical being 90-degrees. Angles below horizontal are negative

- Angles are calculated as the slopes of the trajectories of the curves as defined by the last 14 days data points.

OBSERVATIONS

US states seem to be either doing really well or really bad. There are very few in-between.

New York, New Jersey, Illinois, Massachusetts & Pennsylvania are all performing exceptionally well with:

- mobility outpacing infections,

- mobility outpacing Rt and

- Rt less than 1

Michigan is performing reasonably well with mobility outpacing infections, mobility outpacing Rt but Rt greater than 1. This could fall back into a 2nd wave of infections.

Maryland & Virginia are performing “OK”, with Rt less than 1 but infection growth still outpacing economic mobility improvements.

All the other 4 states are performing badly with daily infections outpacing mobility improvements, mobility improvements marginal and Rt > 1.

Overall US Covid19 Scorecard

Apart from a few large states mentioned above, the US National Covid19 performance peaked a week ago and appears on the decline as it enters a 2nd-wave status. We track 10 metrics daily to score the US National Covid19 situation, with the latest status below:

Our highest 7-day average of daily score of 8.1 was achieved on 28 May 2020 and has been on a steady decline since as various metrics deteriorated.

Second Wave

The US now joins the “second-wave” club – countries where daily infections peaked, but then started growing again as lockdowns were lifted:

Regardless if you consider this wave still being the first wave or part of a second wave, the result is the same – US stock markets will struggle to continue posting higher highs and volatility will increase until one of two things happen:

- Daily infections peak again nationally or at least in the big 12 states we monitor

- FED responds to increased infections with more stimulus

NBER declares 2020 recession dates

The National Bureau for Economic Research (NBER) has announced official start dates for the 2020 US recession. It is very rare for such quick pronouncements (they are normally made 9-12 months after the fact) but the fact that 90% of the economy came to a sudden halt, has led to such deep declines in their metrics that they could make an early pronunciation without risk of being proven wrong later.

The monthly economic peak was declared as February 2020 (first month of recession is March 2020), while the quarterly peak occurred in 2019Q4 (first quarter of recession is 2020Q1).

Note that most of the media and press is interpreting this incorrectly, saying the US entered recession in February 2020. This is of course not true, the economy made a peak in February (its best showing this business cycle) and fell into recession in March (March was first month of contraction).

The NBER declarations are consistent with the dates we have been using in all our charts/reports since mid-April already.

Our first proclamation was made in the 17 April 2020 weekly SuperIndex PDF report and has remained unchanged since it first appeared, namely:

Since this date you would have noticed all NBER recession shading in reports and charts to have commenced in March for monthly frequencies and 1Q2020 for quarterly frequencies.

You can read the NBER declaration over here

We are estimating the economy to trough in May or June, but more on that later.

Some updates & market observations

The STM Seasonality Model is a unique composite that looks at average monthly gains, gain-to-loss ratios and percentage of winning months for 1,2,3 and 4 year cycles to arrive at a composite seasonality score for each month. For the last 18 months, the model has been running at 80% directional accuracy on calls on the SP500 future direction which is rather remarkable given the strange times we are living in.

Even though May month was forecast as a non-leveraged long month, the gains for May are not expected to be that large, in fact they could even be slightly down. It is the months of June and especially July that are materially bearish though:

The STM chart is updated with quite a bit of breakdown detail once per month with a 3-month look-ahead, as shown below:

You can read about the STM methodology at the following research note.

You will notice that all charts, data-files, dashboards and SuperIndex reports continue to be updated through Saturdays early morning (4am) and by no later Sunday 5pm US eastern time.

We are also now tracking the current Seasonality Signal, the Yield Curve Complex Diffusion and US Covid-19 situation in the new DASHBOARD page:

You will note from the above that 1 of the 10 yield curve aggregate components has inverted, moving us out of the SAFE zone. You can see from the Yield Curve Chart that it is the two less one year that has inverted:

You can read about this recession forecasting model in our August 2019 warning of an impending recession in this link .

Whilst our August note seemed prescient in penning in an earliest recession date of April 2020, we were hopelessly wrong on the severity of the recession, since this was triggered by an exogenous (black swan) shock followed by a voluntary hard stop of the majority of the US economy due to the Covid-19 global pandemic (which we warned of in first week of March 2020, before WHO). As we now know, this recession is anything but shallow, breaking all the historical records on just about any measure you care to look at.

While we are on the Covid19 topic we are now tracking the daily US Coronavirus situation in the dashboard gauges as well, and this just indicates the last pane in the COVID19 dashboard which is the score out of 10 :

At the moment, 8 out of the possible 10 metrics we track are moving in the right direction and as you can see the scoring metric has steadily climbed from a reading of two to well above 6 now.

SP-500 and Recessions

We examined SP-500 behavior in the lead to and during US recessions a few years ago in an old research note (Recession – Just how much warning is useful anyway?) to conclude that more than 5-months warning before a recession was not constructive, and that you should focus on recession warning models that stuck to a 4-6 month historical lead time as close as possible.